Page 90 - Annual Report 2015 EN

P. 90

Financial Statements

• Experience: loss of €130,093 mainly due to higher than assumed salary increases over the period and

population mobility being lower than expected.

According to IAS19 Revised, the entire actuarial gains or losses that arise in each accounting period are

recognized immediately in the Statement of Other Comprehensive Income (OCI). In this case, the gain

arising over 2015 (i.e. €204,230) is recognized as an income in the OCI statement.

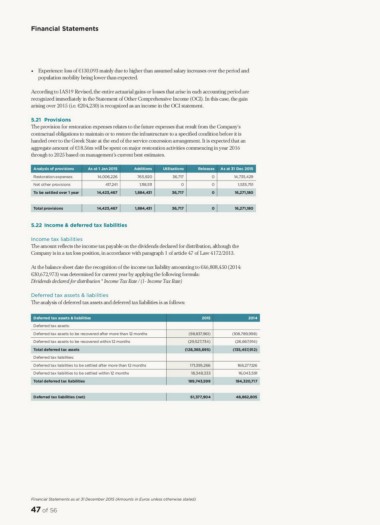

5.21 Provisions

The provision for restoration expenses relates to the future expenses that result from the Company’s

contractual obligations to maintain or to restore the infrastructure to a specified condition before it is

handed over to the Greek State at the end of the service concession arrangement. It is expected that an

aggregate amount of €18.56m will be spent on major restoration activities commencing in year 2016

through to 2025 based on management’s current best estimates.

Analysis of provisions As at 1 Jan 2015 Additions Utilisations Releases As at 31 Dec 2015

Restoration expenses 14,006,226 765,920 36,717 0 14,735,429

Net other provisions 417,241 1,118,511 0 0 1,535,751

To be settled over 1 year 14,423,467 36,717 0 16,271,180

1,884,431

Total provisions 14,423,467 1,884,431 36,717 0 16,271,180

5.22 Income & deferred tax liabilities

Income tax liabilities

The amount reflects the income tax payable on the dividends declared for distribution, although the

Company is in a tax loss position, in accordance with paragraph 1 of article 47 of Law 4172/2013.

At the balance sheet date the recognition of the income tax liability amounting to €46,808,450 (2014:

€30,672,973) was determined for current year by applying the following formula:

Dividends declared for distribution * Income Tax Rate / (1- Income Tax Rate)

Deferred tax assets & liabilities

The analysis of deferred tax assets and deferred tax liabilities is as follows:

Deferred tax assets & liabilities 2015 2014

Deferred tax assets:

Deferred tax assets to be recovered after more than 12 months (98,837,961) (108,789,998)

Deferred tax assets to be recovered within 12 months (29,527,734) (26,667,914)

Total deferred tax assets (128,365,695)

Deferred tax liabilities: (135,457,912)

Deferred tax liabilities to be settled after more than 12 months 171,395,266

Deferred tax liabilities to be settled within 12 months 18,348,333 168,277,126

Total deferred tax liabilities 189,743,599 16,043,591

184,320,717

Deferred tax liabilities (net) 61,377,904 48,862,805

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

47 of 56

• Experience: loss of €130,093 mainly due to higher than assumed salary increases over the period and

population mobility being lower than expected.

According to IAS19 Revised, the entire actuarial gains or losses that arise in each accounting period are

recognized immediately in the Statement of Other Comprehensive Income (OCI). In this case, the gain

arising over 2015 (i.e. €204,230) is recognized as an income in the OCI statement.

5.21 Provisions

The provision for restoration expenses relates to the future expenses that result from the Company’s

contractual obligations to maintain or to restore the infrastructure to a specified condition before it is

handed over to the Greek State at the end of the service concession arrangement. It is expected that an

aggregate amount of €18.56m will be spent on major restoration activities commencing in year 2016

through to 2025 based on management’s current best estimates.

Analysis of provisions As at 1 Jan 2015 Additions Utilisations Releases As at 31 Dec 2015

Restoration expenses 14,006,226 765,920 36,717 0 14,735,429

Net other provisions 417,241 1,118,511 0 0 1,535,751

To be settled over 1 year 14,423,467 36,717 0 16,271,180

1,884,431

Total provisions 14,423,467 1,884,431 36,717 0 16,271,180

5.22 Income & deferred tax liabilities

Income tax liabilities

The amount reflects the income tax payable on the dividends declared for distribution, although the

Company is in a tax loss position, in accordance with paragraph 1 of article 47 of Law 4172/2013.

At the balance sheet date the recognition of the income tax liability amounting to €46,808,450 (2014:

€30,672,973) was determined for current year by applying the following formula:

Dividends declared for distribution * Income Tax Rate / (1- Income Tax Rate)

Deferred tax assets & liabilities

The analysis of deferred tax assets and deferred tax liabilities is as follows:

Deferred tax assets & liabilities 2015 2014

Deferred tax assets:

Deferred tax assets to be recovered after more than 12 months (98,837,961) (108,789,998)

Deferred tax assets to be recovered within 12 months (29,527,734) (26,667,914)

Total deferred tax assets (128,365,695)

Deferred tax liabilities: (135,457,912)

Deferred tax liabilities to be settled after more than 12 months 171,395,266

Deferred tax liabilities to be settled within 12 months 18,348,333 168,277,126

Total deferred tax liabilities 189,743,599 16,043,591

184,320,717

Deferred tax liabilities (net) 61,377,904 48,862,805

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

47 of 56