Page 85 - Annual Report 2015 EN

P. 85

Annual Report 2015

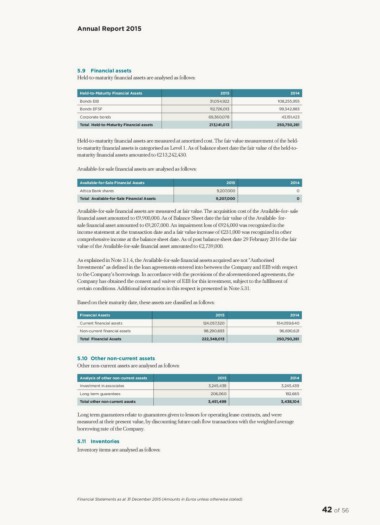

5.9 Financial assets

Held-to-maturity financial assets are analysed as follows:

Held-to-Maturity Financial Assets 2015 2014

Bonds EIB 31,054,922 108,255,955

Bonds EFSF 112,726,013 99,342,883

Corporate bonds 69,360,078

Total Held-to-Maturity Financial assets 213,141,013 43,151,423

250,750,261

Held-to-maturity financial assets are measured at amortized cost. The fair value measurement of the held-

to-maturity financial assets is categorised as Level 1. As of balance sheet date the fair value of the held-to-

maturity financial assets amounted to €213,242,430.

Available-for-sale financial assets are analysed as follows:

Available-for-Sale Financial Assets 2015 2014

Attica Bank shares 9,207,000 0

Total Available-for-Sale Financial Assets 9,207,000 0

Available-for-sale financial assets are measured at fair value. The acquisition cost of the Available-for- sale

financial asset amounted to €9,900,000. As of Balance Sheet date the fair value of the Available- for-

sale financial asset amounted to €9,207,000. An impairment loss of €924,000 was recognized in the

income statement at the transaction date and a fair value increase of €231,000 was recognized in other

comprehensive income at the balance sheet date. As of post balance sheet date 29 February 2016 the fair

value of the Available-for-sale financial asset amounted to €2,739,000.

As explained in Note 3.1.4, the Available-for-sale financial assets acquired are not “Authorised

Investments” as defined in the loan agreements entered into between the Company and EIB with respect

to the Company’s borrowings. In accordance with the provisions of the aforementioned agreements, the

Company has obtained the consent and waiver of EIB for this investment, subject to the fulfilment of

certain conditions. Additional information in this respect is presented in Note 5.31.

Based on their maturity date, these assets are classified as follows:

Financial Assets 2015 2014

Current nancial assets 124,057,320 154,059,640

Non-current nancial assets 98,290,693

Total Financial Assets 222,348,013 96,690,621

250,750,261

5.10 Other non-current assets

Other non-current assets are analysed as follows:

Analysis of other non-current assets 2015 2014

Investment in associates 3,245,439 3,245,439

Long term guarantees

Total other non current assets 206,060 192,665

3,451,499 3,438,104

Long term guarantees relate to guarantees given to lessors for operating lease contracts, and were

measured at their present value, by discounting future cash flow transactions with the weighted average

borrowing rate of the Company.

5.11 Inventories

Inventory items are analysed as follows:

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

42 of 56

5.9 Financial assets

Held-to-maturity financial assets are analysed as follows:

Held-to-Maturity Financial Assets 2015 2014

Bonds EIB 31,054,922 108,255,955

Bonds EFSF 112,726,013 99,342,883

Corporate bonds 69,360,078

Total Held-to-Maturity Financial assets 213,141,013 43,151,423

250,750,261

Held-to-maturity financial assets are measured at amortized cost. The fair value measurement of the held-

to-maturity financial assets is categorised as Level 1. As of balance sheet date the fair value of the held-to-

maturity financial assets amounted to €213,242,430.

Available-for-sale financial assets are analysed as follows:

Available-for-Sale Financial Assets 2015 2014

Attica Bank shares 9,207,000 0

Total Available-for-Sale Financial Assets 9,207,000 0

Available-for-sale financial assets are measured at fair value. The acquisition cost of the Available-for- sale

financial asset amounted to €9,900,000. As of Balance Sheet date the fair value of the Available- for-

sale financial asset amounted to €9,207,000. An impairment loss of €924,000 was recognized in the

income statement at the transaction date and a fair value increase of €231,000 was recognized in other

comprehensive income at the balance sheet date. As of post balance sheet date 29 February 2016 the fair

value of the Available-for-sale financial asset amounted to €2,739,000.

As explained in Note 3.1.4, the Available-for-sale financial assets acquired are not “Authorised

Investments” as defined in the loan agreements entered into between the Company and EIB with respect

to the Company’s borrowings. In accordance with the provisions of the aforementioned agreements, the

Company has obtained the consent and waiver of EIB for this investment, subject to the fulfilment of

certain conditions. Additional information in this respect is presented in Note 5.31.

Based on their maturity date, these assets are classified as follows:

Financial Assets 2015 2014

Current nancial assets 124,057,320 154,059,640

Non-current nancial assets 98,290,693

Total Financial Assets 222,348,013 96,690,621

250,750,261

5.10 Other non-current assets

Other non-current assets are analysed as follows:

Analysis of other non-current assets 2015 2014

Investment in associates 3,245,439 3,245,439

Long term guarantees

Total other non current assets 206,060 192,665

3,451,499 3,438,104

Long term guarantees relate to guarantees given to lessors for operating lease contracts, and were

measured at their present value, by discounting future cash flow transactions with the weighted average

borrowing rate of the Company.

5.11 Inventories

Inventory items are analysed as follows:

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

42 of 56