Page 86 - Annual Report 2015 EN

P. 86

Financial Statements

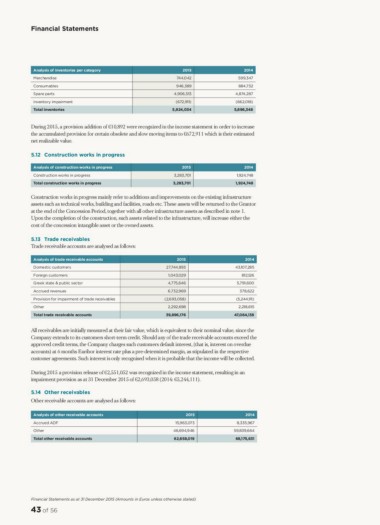

Analysis of inventories per category 2015 2014

Merchandise 744,042 599,347

Consumables 946,389 884,732

Spare parts 4,906,513 4,874,287

Inventory impairment (672,911) (662,018)

Total inventories 5,924,034 5,696,348

During 2015, a provision addition of €10,892 were recognized in the income statement in order to increase

the accumulated provision for certain obsolete and slow moving items to €672,911 which is their estimated

net realizable value.

5.12 Construction works in progress

Analysis of construction works in progress 2015 2014

Construction works in progress 3,283,701 1,924,748

Total construction works in progress 3,283,701 1,924,748

Construction works in progress mainly refer to additions and improvements on the existing infrastructure

assets such as technical works, building and facilities, roads etc. These assets will be returned to the Grantor

at the end of the Concession Period, together with all other infrastructure assets as described in note 1.

Upon the completion of the construction, such assets related to the infrastructure, will increase either the

cost of the concession intangible asset or the owned assets.

5.13 Trade receivables

Trade receivable accounts are analysed as follows:

Analysis of trade receivable accounts 2015 2014

Domestic customers 27,744,893 43,107,285

Foreign customers

Greek state & public sector 1,043,029 812,126

Accrued revenues 4,775,646 5,791,600

Provision for impairment of trade receivables 6,732,969

Other (2,693,058) 378,622

Total trade receivable accounts 2,292,698 (5,244,111)

39,896,176

2,218,615

47,064,138

All receivables are initially measured at their fair value, which is equivalent to their nominal value, since the

Company extends to its customers short-term credit. Should any of the trade receivable accounts exceed the

approved credit terms, the Company charges such customers default interest, (that is, interest on overdue

accounts) at 6 months Euribor interest rate plus a pre-determined margin, as stipulated in the respective

customer agreements. Such interest is only recognised when it is probable that the income will be collected.

During 2015 a provision release of €2,551,052 was recognized in the income statement, resulting in an

impairment provision as at 31 December 2015 of €2,693,058 (2014: €5,244,111).

5.14 Other receivables

Other receivable accounts are analysed as follows:

Analysis of other receivable accounts 2015 2014

Accrued ADF 15,963,073 8,335,967

Other 46,694,946 59,839,664

Total other receivable accounts 62,658,019 68,175,631

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

43 of 56

Analysis of inventories per category 2015 2014

Merchandise 744,042 599,347

Consumables 946,389 884,732

Spare parts 4,906,513 4,874,287

Inventory impairment (672,911) (662,018)

Total inventories 5,924,034 5,696,348

During 2015, a provision addition of €10,892 were recognized in the income statement in order to increase

the accumulated provision for certain obsolete and slow moving items to €672,911 which is their estimated

net realizable value.

5.12 Construction works in progress

Analysis of construction works in progress 2015 2014

Construction works in progress 3,283,701 1,924,748

Total construction works in progress 3,283,701 1,924,748

Construction works in progress mainly refer to additions and improvements on the existing infrastructure

assets such as technical works, building and facilities, roads etc. These assets will be returned to the Grantor

at the end of the Concession Period, together with all other infrastructure assets as described in note 1.

Upon the completion of the construction, such assets related to the infrastructure, will increase either the

cost of the concession intangible asset or the owned assets.

5.13 Trade receivables

Trade receivable accounts are analysed as follows:

Analysis of trade receivable accounts 2015 2014

Domestic customers 27,744,893 43,107,285

Foreign customers

Greek state & public sector 1,043,029 812,126

Accrued revenues 4,775,646 5,791,600

Provision for impairment of trade receivables 6,732,969

Other (2,693,058) 378,622

Total trade receivable accounts 2,292,698 (5,244,111)

39,896,176

2,218,615

47,064,138

All receivables are initially measured at their fair value, which is equivalent to their nominal value, since the

Company extends to its customers short-term credit. Should any of the trade receivable accounts exceed the

approved credit terms, the Company charges such customers default interest, (that is, interest on overdue

accounts) at 6 months Euribor interest rate plus a pre-determined margin, as stipulated in the respective

customer agreements. Such interest is only recognised when it is probable that the income will be collected.

During 2015 a provision release of €2,551,052 was recognized in the income statement, resulting in an

impairment provision as at 31 December 2015 of €2,693,058 (2014: €5,244,111).

5.14 Other receivables

Other receivable accounts are analysed as follows:

Analysis of other receivable accounts 2015 2014

Accrued ADF 15,963,073 8,335,967

Other 46,694,946 59,839,664

Total other receivable accounts 62,658,019 68,175,631

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

43 of 56