Page 82 - Annual Report 2015 EN

P. 82

Financial Statements

Any subsidies receivable in excess of qualifying interest and related expenses for the year are shown as

other revenues in line with the accounting policy 2.13.

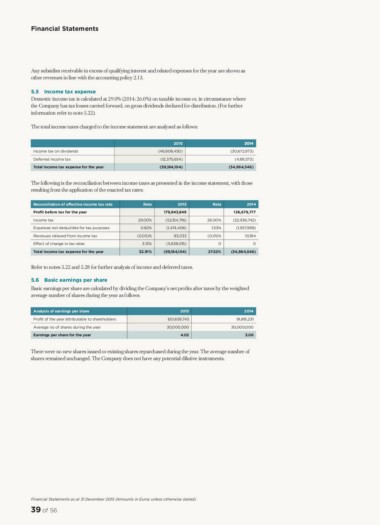

5.5 Income tax expense

Domestic income tax is calculated at 29.0% (2014: 26.0%) on taxable income or, in circumstance where

the Company has tax losses carried forward, on gross dividends declared for distribution. (For further

information refer to note 5.22).

The total income taxes charged to the income statement are analysed as follows:

Income tax on dividends 2015 2014

Deferred income tax (46,808,450) (30,672,973)

Total income tax expense for the year

(12,375,654) (4,191,573)

(59,184,104) (34,864,546)

The following is the reconciliation between income taxes as presented in the income statement, with those

resulting from the application of the enacted tax rates:

Reconciliation of effective income tax rate Rate 2015 Rate 2014

Pro t before tax for the year 179,843,849 126,679,777

Income tax 29.00% (52,154,716) 26.00% (32,936,742)

Expenses not deductible for tax purposes 0.82% 1.53%

Revenues relieved from income tax (1,474,406) (1,937,998)

Effect of change in tax rates (0.05)% 83,033 (0.01)% 10,194

Total income tax expense for the year 3.13% 0 0

(5,638,015)

32.91% (59,184,104) 27.52% (34,864,546)

Refer to notes 5.22 and 5.28 for further analysis of income and deferred taxes.

5.6 Basic earnings per share

Basic earnings per share are calculated by dividing the Company’s net profits after taxes by the weighted

average number of shares during the year as follows:

Analysis of earnings per share 2015 2014

Pro t of the year attributable to shareholders 120,659,745 91,815,231

Average no of shares during the year 30,000,000 30,000,000

Earnings per share for the year

4.02 3.06

There were no new shares issued or existing shares repurchased during the year. The average number of

shares remained unchanged. The Company does not have any potential dilutive instruments.

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

39 of 56

Any subsidies receivable in excess of qualifying interest and related expenses for the year are shown as

other revenues in line with the accounting policy 2.13.

5.5 Income tax expense

Domestic income tax is calculated at 29.0% (2014: 26.0%) on taxable income or, in circumstance where

the Company has tax losses carried forward, on gross dividends declared for distribution. (For further

information refer to note 5.22).

The total income taxes charged to the income statement are analysed as follows:

Income tax on dividends 2015 2014

Deferred income tax (46,808,450) (30,672,973)

Total income tax expense for the year

(12,375,654) (4,191,573)

(59,184,104) (34,864,546)

The following is the reconciliation between income taxes as presented in the income statement, with those

resulting from the application of the enacted tax rates:

Reconciliation of effective income tax rate Rate 2015 Rate 2014

Pro t before tax for the year 179,843,849 126,679,777

Income tax 29.00% (52,154,716) 26.00% (32,936,742)

Expenses not deductible for tax purposes 0.82% 1.53%

Revenues relieved from income tax (1,474,406) (1,937,998)

Effect of change in tax rates (0.05)% 83,033 (0.01)% 10,194

Total income tax expense for the year 3.13% 0 0

(5,638,015)

32.91% (59,184,104) 27.52% (34,864,546)

Refer to notes 5.22 and 5.28 for further analysis of income and deferred taxes.

5.6 Basic earnings per share

Basic earnings per share are calculated by dividing the Company’s net profits after taxes by the weighted

average number of shares during the year as follows:

Analysis of earnings per share 2015 2014

Pro t of the year attributable to shareholders 120,659,745 91,815,231

Average no of shares during the year 30,000,000 30,000,000

Earnings per share for the year

4.02 3.06

There were no new shares issued or existing shares repurchased during the year. The average number of

shares remained unchanged. The Company does not have any potential dilutive instruments.

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

39 of 56