Page 77 - Annual Report 2015 EN

P. 77

Annual Report 2015

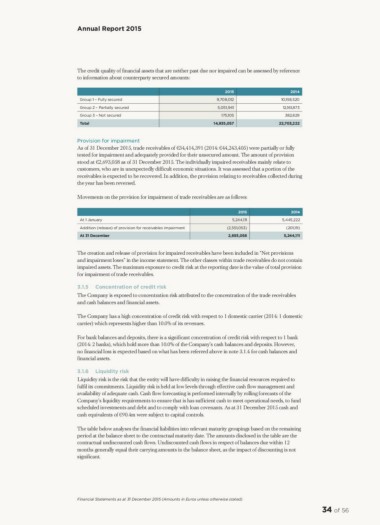

The credit quality of financial assets that are neither past due nor impaired can be assessed by reference

to information about counterparty secured amounts:

Group 1 – Fully secured 2015 2014

Group 2 – Partially secured 9,708,012 10,158,520

Group 3 – Not secured 5,051,941 12,161,873

Total

175,105 382,829

14,935,057 22,703,222

Provision for impairment

As of 31 December 2015, trade receivables of €34,414,391 (2014: €44,243,405) were partially or fully

tested for impairment and adequately provided for their unsecured amount. The amount of provision

stood at €2,693,058 as of 31 December 2015. The individually impaired receivables mainly relate to

customers, who are in unexpectedly difficult economic situations. It was assessed that a portion of the

receivables is expected to be recovered. In addition, the provision relating to receivables collected during

the year has been reversed.

Movements on the provision for impairment of trade receivables are as follows:

At 1 January 2015 2014

Addition (release) of provision for receivables impairment 5,244,111 5,445,222

At 31 December (2,551,053)

2,693,058 (201,111)

5,244,111

The creation and release of provision for impaired receivables have been included in “Net provisions

and impairment loses” in the income statement. The other classes within trade receivables do not contain

impaired assets. The maximum exposure to credit risk at the reporting date is the value of total provision

for impairment of trade receivables.

3.1.5 Concentration of credit risk

The Company is exposed to concentration risk attributed to the concentration of the trade receivables

and cash balances and financial assets.

The Company has a high concentration of credit risk with respect to 1 domestic carrier (2014: 1 domestic

carrier) which represents higher than 10.0% of its revenues.

For bank balances and deposits, there is a significant concentration of credit risk with respect to 1 bank

(2014: 2 banks), which hold more than 10.0% of the Company’s cash balances and deposits. However,

no financial loss is expected based on what has been referred above in note 3.1.4 for cash balances and

financial assets.

3.1.6 Liquidity risk

Liquidity risk is the risk that the entity will have difficulty in raising the financial resources required to

fulfil its commitments. Liquidity risk is held at low levels through effective cash flow management and

availability of adequate cash. Cash flow forecasting is performed internally by rolling forecasts of the

Company’s liquidity requirements to ensure that is has sufficient cash to meet operational needs, to fund

scheduled investments and debt and to comply with loan covenants. As at 31 December 2015 cash and

cash equivalents of €90.4m were subject to capital controls.

The table below analyses the financial liabilities into relevant maturity groupings based on the remaining

period at the balance sheet to the contractual maturity date. The amounts disclosed in the table are the

contractual undiscounted cash flows. Undiscounted cash flows in respect of balances due within 12

months generally equal their carrying amounts in the balance sheet, as the impact of discounting is not

significant.

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

34 of 56

The credit quality of financial assets that are neither past due nor impaired can be assessed by reference

to information about counterparty secured amounts:

Group 1 – Fully secured 2015 2014

Group 2 – Partially secured 9,708,012 10,158,520

Group 3 – Not secured 5,051,941 12,161,873

Total

175,105 382,829

14,935,057 22,703,222

Provision for impairment

As of 31 December 2015, trade receivables of €34,414,391 (2014: €44,243,405) were partially or fully

tested for impairment and adequately provided for their unsecured amount. The amount of provision

stood at €2,693,058 as of 31 December 2015. The individually impaired receivables mainly relate to

customers, who are in unexpectedly difficult economic situations. It was assessed that a portion of the

receivables is expected to be recovered. In addition, the provision relating to receivables collected during

the year has been reversed.

Movements on the provision for impairment of trade receivables are as follows:

At 1 January 2015 2014

Addition (release) of provision for receivables impairment 5,244,111 5,445,222

At 31 December (2,551,053)

2,693,058 (201,111)

5,244,111

The creation and release of provision for impaired receivables have been included in “Net provisions

and impairment loses” in the income statement. The other classes within trade receivables do not contain

impaired assets. The maximum exposure to credit risk at the reporting date is the value of total provision

for impairment of trade receivables.

3.1.5 Concentration of credit risk

The Company is exposed to concentration risk attributed to the concentration of the trade receivables

and cash balances and financial assets.

The Company has a high concentration of credit risk with respect to 1 domestic carrier (2014: 1 domestic

carrier) which represents higher than 10.0% of its revenues.

For bank balances and deposits, there is a significant concentration of credit risk with respect to 1 bank

(2014: 2 banks), which hold more than 10.0% of the Company’s cash balances and deposits. However,

no financial loss is expected based on what has been referred above in note 3.1.4 for cash balances and

financial assets.

3.1.6 Liquidity risk

Liquidity risk is the risk that the entity will have difficulty in raising the financial resources required to

fulfil its commitments. Liquidity risk is held at low levels through effective cash flow management and

availability of adequate cash. Cash flow forecasting is performed internally by rolling forecasts of the

Company’s liquidity requirements to ensure that is has sufficient cash to meet operational needs, to fund

scheduled investments and debt and to comply with loan covenants. As at 31 December 2015 cash and

cash equivalents of €90.4m were subject to capital controls.

The table below analyses the financial liabilities into relevant maturity groupings based on the remaining

period at the balance sheet to the contractual maturity date. The amounts disclosed in the table are the

contractual undiscounted cash flows. Undiscounted cash flows in respect of balances due within 12

months generally equal their carrying amounts in the balance sheet, as the impact of discounting is not

significant.

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

34 of 56