Page 78 - Annual Report 2015 EN

P. 78

Financial Statements

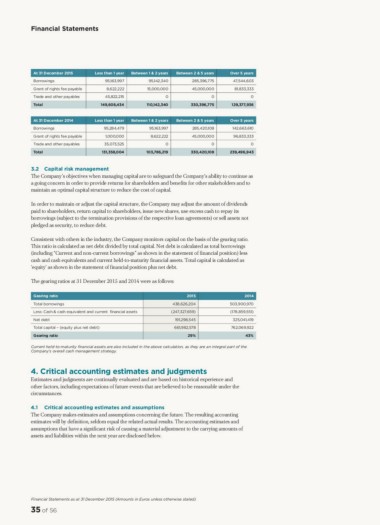

At 31 December 2015 Less than 1 year Between 1 & 2 years Between 2 & 5 years Over 5 years

Borrowings 95,163,997 95,142,340 285,396,775 47,544,603

Grant of rights fee payable 8,622,222 15,000,000 45,000,000 81,833,333

Trade and other payables 45,822,215 0 0 0

Total 330,396,775 129,377,936

149,608,434 110,142,340

At 31 December 2014 Less than 1 year Between 1 & 2 years Between 2 & 5 years Over 5 years

Borrowings 95,284,479 95,163,997 285,420,108 142,663,610

Grant of rights fee payable 1,000,000 8,622,222 45,000,000 96,833,333

Trade and other payables 35,073,525 0 0 0

Total 330,420,108

131,358,004 103,786,219 239,496,943

3.2 Capital risk management

The Company’s objectives when managing capital are to safeguard the Company’s ability to continue as

a going concern in order to provide returns for shareholders and benefits for other stakeholders and to

maintain an optimal capital structure to reduce the cost of capital.

In order to maintain or adjust the capital structure, the Company may adjust the amount of dividends

paid to shareholders, return capital to shareholders, issue new shares, use excess cash to repay its

borrowings (subject to the termination provisions of the respective loan agreements) or sell assets not

pledged as security, to reduce debt.

Consistent with others in the industry, the Company monitors capital on the basis of the gearing ratio.

This ratio is calculated as net debt divided by total capital. Net debt is calculated as total borrowings

(including “Current and non-current borrowings” as shown in the statement of financial position) less

cash and cash equivalents and current held-to-maturity financial assets. Total capital is calculated as

‘equity’ as shown in the statement of financial position plus net debt.

The gearing ratios at 31 December 2015 and 2014 were as follows:

Gearing ratio 2015 2014

Total borrowings 438,626,204 503,900,970

Less: Cash & cash equivalent and current nancial assets (247,327,659) (178,859,551)

Net debt

Total capital – (equity plus net debt) 191,298,545 325,041,419

Gearing ratio 661,982,578 762,069,922

29% 43%

Current held-to-maturity nancial assets are also included in the above calculation, as they are an integral part of the

Company’s overall cash management strategy.

4. Critical accounting estimates and judgments

Estimates and judgments are continually evaluated and are based on historical experience and

other factors, including expectations of future events that are believed to be reasonable under the

circumstances.

4.1 Critical accounting estimates and assumptions

The Company makes estimates and assumptions concerning the future. The resulting accounting

estimates will by definition, seldom equal the related actual results. The accounting estimates and

assumptions that have a significant risk of causing a material adjustment to the carrying amounts of

assets and liabilities within the next year are disclosed below.

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

35 of 56

At 31 December 2015 Less than 1 year Between 1 & 2 years Between 2 & 5 years Over 5 years

Borrowings 95,163,997 95,142,340 285,396,775 47,544,603

Grant of rights fee payable 8,622,222 15,000,000 45,000,000 81,833,333

Trade and other payables 45,822,215 0 0 0

Total 330,396,775 129,377,936

149,608,434 110,142,340

At 31 December 2014 Less than 1 year Between 1 & 2 years Between 2 & 5 years Over 5 years

Borrowings 95,284,479 95,163,997 285,420,108 142,663,610

Grant of rights fee payable 1,000,000 8,622,222 45,000,000 96,833,333

Trade and other payables 35,073,525 0 0 0

Total 330,420,108

131,358,004 103,786,219 239,496,943

3.2 Capital risk management

The Company’s objectives when managing capital are to safeguard the Company’s ability to continue as

a going concern in order to provide returns for shareholders and benefits for other stakeholders and to

maintain an optimal capital structure to reduce the cost of capital.

In order to maintain or adjust the capital structure, the Company may adjust the amount of dividends

paid to shareholders, return capital to shareholders, issue new shares, use excess cash to repay its

borrowings (subject to the termination provisions of the respective loan agreements) or sell assets not

pledged as security, to reduce debt.

Consistent with others in the industry, the Company monitors capital on the basis of the gearing ratio.

This ratio is calculated as net debt divided by total capital. Net debt is calculated as total borrowings

(including “Current and non-current borrowings” as shown in the statement of financial position) less

cash and cash equivalents and current held-to-maturity financial assets. Total capital is calculated as

‘equity’ as shown in the statement of financial position plus net debt.

The gearing ratios at 31 December 2015 and 2014 were as follows:

Gearing ratio 2015 2014

Total borrowings 438,626,204 503,900,970

Less: Cash & cash equivalent and current nancial assets (247,327,659) (178,859,551)

Net debt

Total capital – (equity plus net debt) 191,298,545 325,041,419

Gearing ratio 661,982,578 762,069,922

29% 43%

Current held-to-maturity nancial assets are also included in the above calculation, as they are an integral part of the

Company’s overall cash management strategy.

4. Critical accounting estimates and judgments

Estimates and judgments are continually evaluated and are based on historical experience and

other factors, including expectations of future events that are believed to be reasonable under the

circumstances.

4.1 Critical accounting estimates and assumptions

The Company makes estimates and assumptions concerning the future. The resulting accounting

estimates will by definition, seldom equal the related actual results. The accounting estimates and

assumptions that have a significant risk of causing a material adjustment to the carrying amounts of

assets and liabilities within the next year are disclosed below.

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

35 of 56