Page 76 - Annual Report 2015 EN

P. 76

Financial Statements

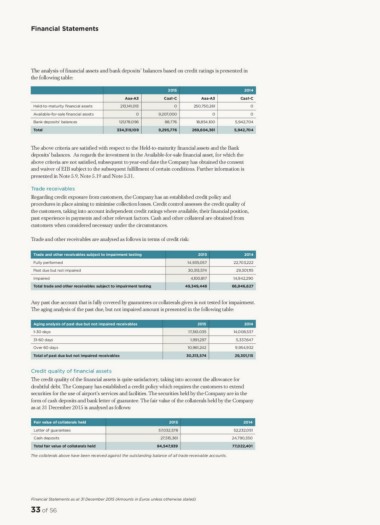

The analysis of financial assets and bank deposits’ balances based on credit ratings is presented in

the following table:

Held-to-maturity nancial assets Aaa-A3 2015 Aaa-A3 2014

Available-for-sale nancial assets 213,141,013 Caa1-C 250,750,261 Caa1-C

Bank deposits’ balances

Total 0 0 0 0

121,178,096 9,207,000 18,854,100 0

334,319,109 269,604,361 5,942,704

88,776 5,942,704

9,295,776

The above criteria are satisfied with respect to the Held-to-maturity financial assets and the Bank

deposits’ balances. As regards the investment in the Available-for-sale financial asset, for which the

above criteria are not satisfied, subsequent to year-end date the Company has obtained the consent

and waiver of EIB subject to the subsequent fulfillment of certain conditions. Further information is

presented in Note 5.9, Note 5.19 and Note 5.31.

Trade receivables

Regarding credit exposure from customers, the Company has an established credit policy and

procedures in place aiming to minimise collection losses. Credit control assesses the credit quality of

the customers, taking into account independent credit ratings where available, their financial position,

past experience in payments and other relevant factors. Cash and other collateral are obtained from

customers when considered necessary under the circumstances.

Trade and other receivables are analysed as follows in terms of credit risk:

Trade and other receivables subject to impairment testing 2015 2014

Fully performed 14,935,057 22,703,222

Past due but not impaired 30,313,574

Impaired 29,301,115

Total trade and other receivables subject to impairment testing 4,100,817 14,942,290

49,349,448 66,946,627

Any past due account that is fully covered by guarantees or collaterals given is not tested for impairment.

The aging analysis of the past due, but not impaired amount is presented in the following table:

Aging analysis of past due but not impaired receivables 2015 2014

1-30 days 17,361,035 14,008,537

31-60 days

Over 60 days 1,991,297 5,337,647

Total of past due but not impaired receivables 10,961,242 9,954,932

30,313,574 29,301,115

Credit quality of nancial assets

The credit quality of the financial assets is quite satisfactory, taking into account the allowance for

doubtful debt. The Company has established a credit policy which requires the customers to extend

securities for the use of airport’s services and facilities. The securities held by the Company are in the

form of cash deposits and bank letter of guarantee. The fair value of the collaterals held by the Company

as at 31 December 2015 is analysed as follows:

Fair value of collaterals held 2015 2014

Letter of guarantees 57,032,578 52,232,051

Cash deposits 24,790,350

Total fair value of collaterals held 27,515,361 77,022,401

84,547,939

The collaterals above have been received against the outstanding balance of all trade receivable accounts.

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

33 of 56

The analysis of financial assets and bank deposits’ balances based on credit ratings is presented in

the following table:

Held-to-maturity nancial assets Aaa-A3 2015 Aaa-A3 2014

Available-for-sale nancial assets 213,141,013 Caa1-C 250,750,261 Caa1-C

Bank deposits’ balances

Total 0 0 0 0

121,178,096 9,207,000 18,854,100 0

334,319,109 269,604,361 5,942,704

88,776 5,942,704

9,295,776

The above criteria are satisfied with respect to the Held-to-maturity financial assets and the Bank

deposits’ balances. As regards the investment in the Available-for-sale financial asset, for which the

above criteria are not satisfied, subsequent to year-end date the Company has obtained the consent

and waiver of EIB subject to the subsequent fulfillment of certain conditions. Further information is

presented in Note 5.9, Note 5.19 and Note 5.31.

Trade receivables

Regarding credit exposure from customers, the Company has an established credit policy and

procedures in place aiming to minimise collection losses. Credit control assesses the credit quality of

the customers, taking into account independent credit ratings where available, their financial position,

past experience in payments and other relevant factors. Cash and other collateral are obtained from

customers when considered necessary under the circumstances.

Trade and other receivables are analysed as follows in terms of credit risk:

Trade and other receivables subject to impairment testing 2015 2014

Fully performed 14,935,057 22,703,222

Past due but not impaired 30,313,574

Impaired 29,301,115

Total trade and other receivables subject to impairment testing 4,100,817 14,942,290

49,349,448 66,946,627

Any past due account that is fully covered by guarantees or collaterals given is not tested for impairment.

The aging analysis of the past due, but not impaired amount is presented in the following table:

Aging analysis of past due but not impaired receivables 2015 2014

1-30 days 17,361,035 14,008,537

31-60 days

Over 60 days 1,991,297 5,337,647

Total of past due but not impaired receivables 10,961,242 9,954,932

30,313,574 29,301,115

Credit quality of nancial assets

The credit quality of the financial assets is quite satisfactory, taking into account the allowance for

doubtful debt. The Company has established a credit policy which requires the customers to extend

securities for the use of airport’s services and facilities. The securities held by the Company are in the

form of cash deposits and bank letter of guarantee. The fair value of the collaterals held by the Company

as at 31 December 2015 is analysed as follows:

Fair value of collaterals held 2015 2014

Letter of guarantees 57,032,578 52,232,051

Cash deposits 24,790,350

Total fair value of collaterals held 27,515,361 77,022,401

84,547,939

The collaterals above have been received against the outstanding balance of all trade receivable accounts.

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

33 of 56