Page 75 - Annual Report 2015 EN

P. 75

Annual Report 2015

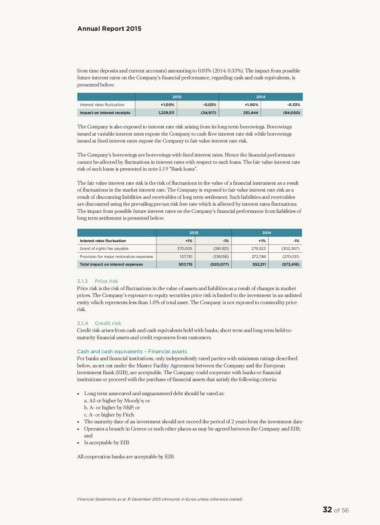

from time deposits and current accounts) amounting to 0.03% (2014: 0.33%). The impact from possible

future interest rates on the Company’s financial performance, regarding cash and cash equivalents, is

presented below:

Interest rates uctuation 2015 -0.03% 2014 -0.33%

Impact on interest receipts +1.00% (34,917) +1.00% (84,050)

1,229,511 251,444

The Company is also exposed to interest rate risk arising from its long-term borrowings. Borrowings

issued at variable interest rates expose the Company to cash flow interest rate risk while borrowings

issued at fixed interest rates expose the Company to fair value interest rate risk.

The Company’s borrowings are borrowings with fixed interest rates. Hence the financial performance

cannot be affected by fluctuations in interest rates with respect to such loans. The fair value interest rate

risk of such loans is presented in note 5.19 “Bank loans”.

The fair value interest rate risk is the risk of fluctuations in the value of a financial instrument as a result

of fluctuations in the market interest rate. The Company is exposed to fair value interest rate risk as a

result of discounting liabilities and receivables of long term settlement. Such liabilities and receivables

are discounted using the prevailing pre-tax risk free rate which is affected by interest rates fluctuations.

The impact from possible future interest rates on the Company’s financial performance from liabilities of

long term settlement is presented below:

Interest rates uctuation 2015 -1% 2014 -1%

Grant of rights fee payable +1% (381,921) +1% (302,387)

Provision for major restoration expenses 370,005 (138,156) 279,523 (270,031)

Total impact on interest expenses 137,710 (520,077) 272,788 (572,418)

507,715 552,311

3.1.3 Price risk

Price risk is the risk of fluctuations in the value of assets and liabilities as a result of changes in market

prices. The Company’s exposure to equity securities price risk is limited to the investment in an unlisted

entity which represents less than 1.0% of total asset. The Company is not exposed to commodity price

risk.

3.1.4 Credit risk

Credit risk arises from cash and cash equivalents held with banks, short term and long term held-to-

maturity financial assets and credit exposures from customers.

Cash and cash equivalents – Financial assets

For banks and financial institutions, only independently rated parties with minimum ratings described

below, as set out under the Master Facility Agreement between the Company and the European

Investment Bank (EIB), are acceptable. The Company could cooperate with banks or financial

institutions or proceed with the purchase of financial assets that satisfy the following criteria:

• Long term unsecured and unguaranteed debt should be rated at:

a. A3 or higher by Moody’s; or

b. A- or higher by S&P; or

c. A- or higher by Fitch

• The maturity date of an investment should not exceed the period of 2 years from the investment date

• Operates a branch in Greece or such other places as may be agreed between the Company and EIB;

and

• Is acceptable by EIB

All cooperation banks are acceptable by EIB.

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

32 of 56

from time deposits and current accounts) amounting to 0.03% (2014: 0.33%). The impact from possible

future interest rates on the Company’s financial performance, regarding cash and cash equivalents, is

presented below:

Interest rates uctuation 2015 -0.03% 2014 -0.33%

Impact on interest receipts +1.00% (34,917) +1.00% (84,050)

1,229,511 251,444

The Company is also exposed to interest rate risk arising from its long-term borrowings. Borrowings

issued at variable interest rates expose the Company to cash flow interest rate risk while borrowings

issued at fixed interest rates expose the Company to fair value interest rate risk.

The Company’s borrowings are borrowings with fixed interest rates. Hence the financial performance

cannot be affected by fluctuations in interest rates with respect to such loans. The fair value interest rate

risk of such loans is presented in note 5.19 “Bank loans”.

The fair value interest rate risk is the risk of fluctuations in the value of a financial instrument as a result

of fluctuations in the market interest rate. The Company is exposed to fair value interest rate risk as a

result of discounting liabilities and receivables of long term settlement. Such liabilities and receivables

are discounted using the prevailing pre-tax risk free rate which is affected by interest rates fluctuations.

The impact from possible future interest rates on the Company’s financial performance from liabilities of

long term settlement is presented below:

Interest rates uctuation 2015 -1% 2014 -1%

Grant of rights fee payable +1% (381,921) +1% (302,387)

Provision for major restoration expenses 370,005 (138,156) 279,523 (270,031)

Total impact on interest expenses 137,710 (520,077) 272,788 (572,418)

507,715 552,311

3.1.3 Price risk

Price risk is the risk of fluctuations in the value of assets and liabilities as a result of changes in market

prices. The Company’s exposure to equity securities price risk is limited to the investment in an unlisted

entity which represents less than 1.0% of total asset. The Company is not exposed to commodity price

risk.

3.1.4 Credit risk

Credit risk arises from cash and cash equivalents held with banks, short term and long term held-to-

maturity financial assets and credit exposures from customers.

Cash and cash equivalents – Financial assets

For banks and financial institutions, only independently rated parties with minimum ratings described

below, as set out under the Master Facility Agreement between the Company and the European

Investment Bank (EIB), are acceptable. The Company could cooperate with banks or financial

institutions or proceed with the purchase of financial assets that satisfy the following criteria:

• Long term unsecured and unguaranteed debt should be rated at:

a. A3 or higher by Moody’s; or

b. A- or higher by S&P; or

c. A- or higher by Fitch

• The maturity date of an investment should not exceed the period of 2 years from the investment date

• Operates a branch in Greece or such other places as may be agreed between the Company and EIB;

and

• Is acceptable by EIB

All cooperation banks are acceptable by EIB.

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

32 of 56