Page 87 - Annual Report 2015 EN

P. 87

Annual Report 2015

Accrued ADF represents the amount of the passengers’ airport fee attributable to the Company, which had

not been collected by the Company at year-end. This amount is estimated to be collected progressively in

year 2016.

Other Accounts Receivable mainly consists of payments for taxes and duties carried out by the Company,

that relate to various tax disputes, as required by relevant laws in order for the tax disputes to be referred

to the competent Courts for resolution. The Company has assessed that these amounts are fully refundable

upon the successful resolution of the legal cases. The major tax disputes as referred also in note 5.28

Contingent Liabilities and involve taxes imposed for VAT, Property Taxes, Special Once Off Taxes and

Municipal Charges.

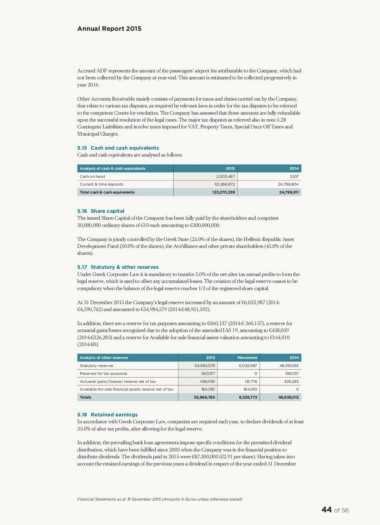

5.15 Cash and cash equivalents

Cash and cash equivalents are analysed as follows:

Analysis of cash & cash equivalents 2015 2014

Cash on hand 2,003,467 3,107

Current & time deposits 121,266,872 24,796,804

Total cash & cash equivalents 123,270,339 24,799,911

5.16 Share capital

The issued Share Capital of the Company has been fully paid by the shareholders and comprises

30,000,000 ordinary shares of €10 each amounting to €300,000,000.

The Company is jointly controlled by the Greek State (25.0% of the shares), the Hellenic Republic Asset

Development Fund (30.0% of the shares), the AviAlliance and other private shareholders (45.0% of the

shares).

5.17 Statutory & other reserves

Under Greek Corporate Law it is mandatory to transfer 5.0% of the net after tax annual profits to form the

legal reserve, which is used to offset any accumulated losses. The creation of the legal reserve ceases to be

compulsory when the balance of the legal reserve reaches 1/3 of the registered share capital.

At 31 December 2015 the Company’s legal reserve increased by an amount of €6,032,987 (2014:

€4,590,762) and amounted to €54,984,579 (2014:€48,951,592).

In addition, there are a reserve for tax purposes amounting to €360,137 (2014:€ 360,137), a reserve for

actuarial gains/losses recognized due to the adoption of the amended IAS 19, amounting to €458,059

(2014:€326,283) and a reserve for Available-for-sale financial assets valuation amounting to €164,010

(2014:€0).

Analysis of other reserves 2015 Movement 2014

Statutory reserves 54,984,579 6,032,987 48,951,592

Reserves for tax purposes

Actuarial gains/(losses) reserve net of tax 360,137 0 360,137

Αvailable-for-sale nancial assets reserve net of tax 458,059 131,776 326,283

Totals 164,010 164,010

55,966,785 6,328,773 0

49,638,012

5.18 Retained earnings

In accordance with Greek Corporate Law, companies are required each year, to declare dividends of at least

35.0% of after tax profits, after allowing for the legal reserve.

In addition, the prevailing bank loan agreements impose specific conditions for the permitted dividend

distribution, which have been fulfilled since 2003 when the Company was in the financial position to

distribute dividends. The dividends paid in 2015 were €87,300,000 (€2.91 per share). Having taken into

account the retained earnings of the previous years a dividend in respect of the year ended 31 December

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

44 of 56

Accrued ADF represents the amount of the passengers’ airport fee attributable to the Company, which had

not been collected by the Company at year-end. This amount is estimated to be collected progressively in

year 2016.

Other Accounts Receivable mainly consists of payments for taxes and duties carried out by the Company,

that relate to various tax disputes, as required by relevant laws in order for the tax disputes to be referred

to the competent Courts for resolution. The Company has assessed that these amounts are fully refundable

upon the successful resolution of the legal cases. The major tax disputes as referred also in note 5.28

Contingent Liabilities and involve taxes imposed for VAT, Property Taxes, Special Once Off Taxes and

Municipal Charges.

5.15 Cash and cash equivalents

Cash and cash equivalents are analysed as follows:

Analysis of cash & cash equivalents 2015 2014

Cash on hand 2,003,467 3,107

Current & time deposits 121,266,872 24,796,804

Total cash & cash equivalents 123,270,339 24,799,911

5.16 Share capital

The issued Share Capital of the Company has been fully paid by the shareholders and comprises

30,000,000 ordinary shares of €10 each amounting to €300,000,000.

The Company is jointly controlled by the Greek State (25.0% of the shares), the Hellenic Republic Asset

Development Fund (30.0% of the shares), the AviAlliance and other private shareholders (45.0% of the

shares).

5.17 Statutory & other reserves

Under Greek Corporate Law it is mandatory to transfer 5.0% of the net after tax annual profits to form the

legal reserve, which is used to offset any accumulated losses. The creation of the legal reserve ceases to be

compulsory when the balance of the legal reserve reaches 1/3 of the registered share capital.

At 31 December 2015 the Company’s legal reserve increased by an amount of €6,032,987 (2014:

€4,590,762) and amounted to €54,984,579 (2014:€48,951,592).

In addition, there are a reserve for tax purposes amounting to €360,137 (2014:€ 360,137), a reserve for

actuarial gains/losses recognized due to the adoption of the amended IAS 19, amounting to €458,059

(2014:€326,283) and a reserve for Available-for-sale financial assets valuation amounting to €164,010

(2014:€0).

Analysis of other reserves 2015 Movement 2014

Statutory reserves 54,984,579 6,032,987 48,951,592

Reserves for tax purposes

Actuarial gains/(losses) reserve net of tax 360,137 0 360,137

Αvailable-for-sale nancial assets reserve net of tax 458,059 131,776 326,283

Totals 164,010 164,010

55,966,785 6,328,773 0

49,638,012

5.18 Retained earnings

In accordance with Greek Corporate Law, companies are required each year, to declare dividends of at least

35.0% of after tax profits, after allowing for the legal reserve.

In addition, the prevailing bank loan agreements impose specific conditions for the permitted dividend

distribution, which have been fulfilled since 2003 when the Company was in the financial position to

distribute dividends. The dividends paid in 2015 were €87,300,000 (€2.91 per share). Having taken into

account the retained earnings of the previous years a dividend in respect of the year ended 31 December

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

44 of 56