Page 92 - Annual Report 2015 EN

P. 92

Financial Statements

The Company pays a quarterly fee to the Greek State during the concession period for the rights and

privileges granted in ADA. The carrying amount of the liability represents the present value of the

future payment that concerns the fixed part of the fee at the balance sheet date. In 2015 a finance charge

amounting to €5,708,799 has been recorded as the unwind interest of the liability due to the passage of

time (2014: €5,478,716). The amount payable within the next 12 months is included in the other current

liabilities. The present value of total future payments at the time of airport opening has been included in

the cost of the intangible concession asset which is amortised over the concession period. An amount of

€2,435,104 is included in 2015 amortisation of the intangible concession asset with respect to the grant of

rights fee (2014: €2,435,104).

Long term securities relate to performance guarantees provided for by the lessees for long- term lease

agreements. Long-term securities are measured at their net present value, by discounting the future cash

flow payments with the weighted average borrowing rate, at the balance sheet date. The weighted average

borrowing rate for the Company for 2015 was at the rate of 6.15%.

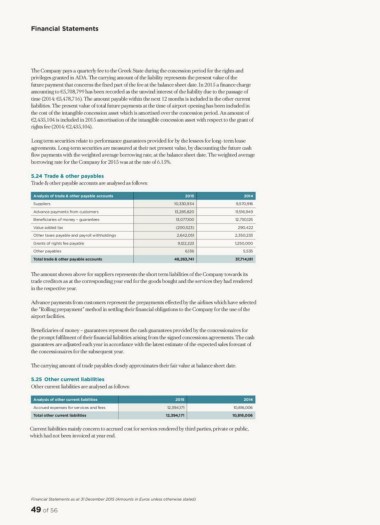

5.24 Trade & other payables

Trade & other payable accounts are analysed as follows:

Analysis of trade & other payable accounts 2015 2014

Suppliers 10,330,934 9,570,916

Advance payments from customers 13,285,820 11,516,949

Bene ciaries of money – guarantees 13,077,100 12,730,125

Value added tax (200,523)

Other taxes payable and payroll withholdings 290,422

Grants of rights fee payable 2,642,051 2,350,233

Other payables 9,122,223 1,250,000

Total trade & other payable accounts

6,136 5,535

48,263,741 37,714,181

The amount shown above for suppliers represents the short term liabilities of the Company towards its

trade creditors as at the corresponding year end for the goods bought and the services they had rendered

in the respective year.

Advance payments from customers represent the prepayments effected by the airlines which have selected

the “Rolling prepayment” method in settling their financial obligations to the Company for the use of the

airport facilities.

Beneficiaries of money – guarantees represent the cash guarantees provided by the concessionaires for

the prompt fulfilment of their financial liabilities arising from the signed concessions agreements. The cash

guarantees are adjusted each year in accordance with the latest estimate of the expected sales forecast of

the concessionaires for the subsequent year.

The carrying amount of trade payables closely approximates their fair value at balance sheet date.

5.25 Other current liabilities

Other current liabilities are analysed as follows:

Analysis of other current liabilities 2015 2014

Accrued expenses for services and fees 12,394,171 10,816,006

Total other current liabilities 12,394,171 10,816,006

Current liabilities mainly concern to accrued cost for services rendered by third parties, private or public,

which had not been invoiced at year end.

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

49 of 56

The Company pays a quarterly fee to the Greek State during the concession period for the rights and

privileges granted in ADA. The carrying amount of the liability represents the present value of the

future payment that concerns the fixed part of the fee at the balance sheet date. In 2015 a finance charge

amounting to €5,708,799 has been recorded as the unwind interest of the liability due to the passage of

time (2014: €5,478,716). The amount payable within the next 12 months is included in the other current

liabilities. The present value of total future payments at the time of airport opening has been included in

the cost of the intangible concession asset which is amortised over the concession period. An amount of

€2,435,104 is included in 2015 amortisation of the intangible concession asset with respect to the grant of

rights fee (2014: €2,435,104).

Long term securities relate to performance guarantees provided for by the lessees for long- term lease

agreements. Long-term securities are measured at their net present value, by discounting the future cash

flow payments with the weighted average borrowing rate, at the balance sheet date. The weighted average

borrowing rate for the Company for 2015 was at the rate of 6.15%.

5.24 Trade & other payables

Trade & other payable accounts are analysed as follows:

Analysis of trade & other payable accounts 2015 2014

Suppliers 10,330,934 9,570,916

Advance payments from customers 13,285,820 11,516,949

Bene ciaries of money – guarantees 13,077,100 12,730,125

Value added tax (200,523)

Other taxes payable and payroll withholdings 290,422

Grants of rights fee payable 2,642,051 2,350,233

Other payables 9,122,223 1,250,000

Total trade & other payable accounts

6,136 5,535

48,263,741 37,714,181

The amount shown above for suppliers represents the short term liabilities of the Company towards its

trade creditors as at the corresponding year end for the goods bought and the services they had rendered

in the respective year.

Advance payments from customers represent the prepayments effected by the airlines which have selected

the “Rolling prepayment” method in settling their financial obligations to the Company for the use of the

airport facilities.

Beneficiaries of money – guarantees represent the cash guarantees provided by the concessionaires for

the prompt fulfilment of their financial liabilities arising from the signed concessions agreements. The cash

guarantees are adjusted each year in accordance with the latest estimate of the expected sales forecast of

the concessionaires for the subsequent year.

The carrying amount of trade payables closely approximates their fair value at balance sheet date.

5.25 Other current liabilities

Other current liabilities are analysed as follows:

Analysis of other current liabilities 2015 2014

Accrued expenses for services and fees 12,394,171 10,816,006

Total other current liabilities 12,394,171 10,816,006

Current liabilities mainly concern to accrued cost for services rendered by third parties, private or public,

which had not been invoiced at year end.

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

49 of 56