Page 93 - Annual Report 2015 EN

P. 93

Annual Report 2015

5.26 Operating lease arrangements

The Company as a lessee

Operating lease payments represent rentals payable by the Company for certain of its vehicles. Leases are

negotiated for an average term of 4 years and rentals are fixed for the same period.

In the current year, minimum lease payments under operating lease, amounting to €221,908, were

recognised in the income statement, while the corresponding amount for the year 2014 was at €215,746.

At the balance sheet date the Company has outstanding commitments under non-cancellable operating

leases, which are presented in note 5.27.

The Company as a lessor

Refer to note 5.1

5.27 Commitments

As at 31 December 2015 the Company has the following significant commitments:

a) Capital expenditure commitments amounting to approximately €6.5m (2014: €3.3m)

b) Operating service commitments, which are estimated to be approximately to €121.4m (2014: €152.0m)

mainly related to security, maintenance, fire protection, transportation, parking and cleaning services,

to be settled as follows:

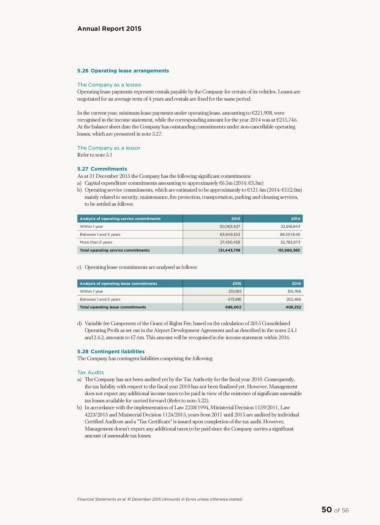

Analysis of operating service commitments 2015 2014

Within 1 year 30,063,927 32,618,843

Between 1 and 5 years 63,949,353 86,557,649

More than 5 years 27,430,458 32,783,873

Total operating service commitments 121,443,738 151,960,365

c) Operating lease commitments are analysed as follows:

Analysis of operating lease commitments 2015 2014

Within 1 year 210,183 155,766

Between 1 and 5 years 475,818 252,486

Total operating lease commitments 686,002 408,252

d) Variable fee Component of the Grant of Rights Fee, based on the calculation of 2015 Consolidated

Operating Profit as set out in the Airport Development Agreement and as described in the notes 2.4.1

and 2.4.2, amounts to €7.6m. This amount will be recognised in the income statement within 2016.

5.28 Contingent liabilities

The Company has contingent liabilities comprising the following:

Tax Audits

a) The Company has not been audited yet by the Tax Authority for the fiscal year 2010. Consequently,

the tax liability with respect to the fiscal year 2010 has not been finalized yet. However, Management

does not expect any additional income taxes to be paid in view of the existence of significant assessable

tax losses available for carried forward (Refer to note 5.22).

b) In accordance with the implementation of Law 2238/1994, Ministerial Decision 1159/2011, Law

4223/2013 and Ministerial Decision 1124/2015, years from 2011 until 2015 are audited by individual

Certified Auditors and a “Tax Certificate” is issued upon completion of the tax audit. However,

Management doesn’t expect any additional taxes to be paid since the Company carries a significant

amount of assessable tax losses.

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

50 of 56

5.26 Operating lease arrangements

The Company as a lessee

Operating lease payments represent rentals payable by the Company for certain of its vehicles. Leases are

negotiated for an average term of 4 years and rentals are fixed for the same period.

In the current year, minimum lease payments under operating lease, amounting to €221,908, were

recognised in the income statement, while the corresponding amount for the year 2014 was at €215,746.

At the balance sheet date the Company has outstanding commitments under non-cancellable operating

leases, which are presented in note 5.27.

The Company as a lessor

Refer to note 5.1

5.27 Commitments

As at 31 December 2015 the Company has the following significant commitments:

a) Capital expenditure commitments amounting to approximately €6.5m (2014: €3.3m)

b) Operating service commitments, which are estimated to be approximately to €121.4m (2014: €152.0m)

mainly related to security, maintenance, fire protection, transportation, parking and cleaning services,

to be settled as follows:

Analysis of operating service commitments 2015 2014

Within 1 year 30,063,927 32,618,843

Between 1 and 5 years 63,949,353 86,557,649

More than 5 years 27,430,458 32,783,873

Total operating service commitments 121,443,738 151,960,365

c) Operating lease commitments are analysed as follows:

Analysis of operating lease commitments 2015 2014

Within 1 year 210,183 155,766

Between 1 and 5 years 475,818 252,486

Total operating lease commitments 686,002 408,252

d) Variable fee Component of the Grant of Rights Fee, based on the calculation of 2015 Consolidated

Operating Profit as set out in the Airport Development Agreement and as described in the notes 2.4.1

and 2.4.2, amounts to €7.6m. This amount will be recognised in the income statement within 2016.

5.28 Contingent liabilities

The Company has contingent liabilities comprising the following:

Tax Audits

a) The Company has not been audited yet by the Tax Authority for the fiscal year 2010. Consequently,

the tax liability with respect to the fiscal year 2010 has not been finalized yet. However, Management

does not expect any additional income taxes to be paid in view of the existence of significant assessable

tax losses available for carried forward (Refer to note 5.22).

b) In accordance with the implementation of Law 2238/1994, Ministerial Decision 1159/2011, Law

4223/2013 and Ministerial Decision 1124/2015, years from 2011 until 2015 are audited by individual

Certified Auditors and a “Tax Certificate” is issued upon completion of the tax audit. However,

Management doesn’t expect any additional taxes to be paid since the Company carries a significant

amount of assessable tax losses.

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

50 of 56