Page 89 - Annual Report 2015 EN

P. 89

Annual Report 2015

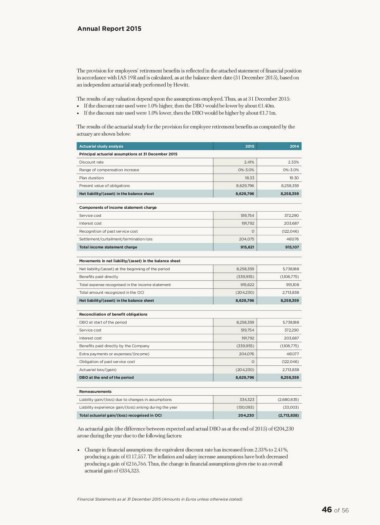

The provision for employees’ retirement benefits is reflected in the attached statement of financial position

in accordance with IAS 19R and is calculated, as at the balance sheet date (31 December 2015), based on

an independent actuarial study performed by Hewitt.

The results of any valuation depend upon the assumptions employed. Thus, as at 31 December 2015:

• If the discount rate used were 1.0% higher, then the DBO would be lower by about €1.40m.

• If the discount rate used were 1.0% lower, then the DBO would be higher by about €1.71m.

The results of the actuarial study for the provision for employee retirement benefits as computed by the

actuary are shown below:

Actuarial study analysis 2015 2014

Principal actuarial assumptions at 31 December 2015

Discount rate 2.41% 2.33%

Range of compensation increase 0%-3.0% 0%-3.0%

Plan duration

Present value of obligations 18.33 19.30

Net liability/(asset) in the balance sheet 8,629,796 8,258,359

8,629,796 8,258,359

Components of income statement charge 519,754 372,290

Service cost 191,792 203,687

Interest cost (122,046)

Recognition of past service cost 0

Settlement/curtailment/termination loss 204,075 461,176

Total income statement charge 915,621 915,107

Movements in net liability/(asset) in the balance sheet 8,258,359 5,738,188

Net liability/(asset) at the beginning of the period (339,955) (1,108,775)

Bene ts paid directly

Total expense recognised in the income statement 915,622 915,108

Total amount recognized in the OCI (204,230) 2,713,838

Net liability/(asset) in the balance sheet 8,629,796 8,258,359

Reconciliation of bene t obligations 8,258,359 5,738,188

DBO at start of the period 519,754 372,290

Service cost 191,792 203,687

Interest cost (1,108,775)

Bene ts paid directly by the Company (339,955)

Extra payments or expenses/(income) 204,076 461,177

Obligation of past service cost 0 (122,046)

Actuarial loss/(gain) 2,713,838

DBO at the end of the period (204,230) 8,258,359

8,629,796

Remeasurements 334,323 (2,680,835)

Liability gain/(loss) due to changes in assumptions (130,093) (33,003)

Liability experience gain/(loss) arising during the year 204,230

Total actuarial gain/(loss) recognised in OCI (2,713,838)

An actuarial gain (the difference between expected and actual DBO as at the end of 2015) of €204,230

arose during the year due to the following factors:

• Change in financial assumptions: the equivalent discount rate has increased from 2.33% to 2.41%,

producing a gain of €117,557. The inflation and salary increase assumptions have both decreased

producing a gain of €216,766. Thus, the change in financial assumptions gives rise to an overall

actuarial gain of €334,323.

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

46 of 56

The provision for employees’ retirement benefits is reflected in the attached statement of financial position

in accordance with IAS 19R and is calculated, as at the balance sheet date (31 December 2015), based on

an independent actuarial study performed by Hewitt.

The results of any valuation depend upon the assumptions employed. Thus, as at 31 December 2015:

• If the discount rate used were 1.0% higher, then the DBO would be lower by about €1.40m.

• If the discount rate used were 1.0% lower, then the DBO would be higher by about €1.71m.

The results of the actuarial study for the provision for employee retirement benefits as computed by the

actuary are shown below:

Actuarial study analysis 2015 2014

Principal actuarial assumptions at 31 December 2015

Discount rate 2.41% 2.33%

Range of compensation increase 0%-3.0% 0%-3.0%

Plan duration

Present value of obligations 18.33 19.30

Net liability/(asset) in the balance sheet 8,629,796 8,258,359

8,629,796 8,258,359

Components of income statement charge 519,754 372,290

Service cost 191,792 203,687

Interest cost (122,046)

Recognition of past service cost 0

Settlement/curtailment/termination loss 204,075 461,176

Total income statement charge 915,621 915,107

Movements in net liability/(asset) in the balance sheet 8,258,359 5,738,188

Net liability/(asset) at the beginning of the period (339,955) (1,108,775)

Bene ts paid directly

Total expense recognised in the income statement 915,622 915,108

Total amount recognized in the OCI (204,230) 2,713,838

Net liability/(asset) in the balance sheet 8,629,796 8,258,359

Reconciliation of bene t obligations 8,258,359 5,738,188

DBO at start of the period 519,754 372,290

Service cost 191,792 203,687

Interest cost (1,108,775)

Bene ts paid directly by the Company (339,955)

Extra payments or expenses/(income) 204,076 461,177

Obligation of past service cost 0 (122,046)

Actuarial loss/(gain) 2,713,838

DBO at the end of the period (204,230) 8,258,359

8,629,796

Remeasurements 334,323 (2,680,835)

Liability gain/(loss) due to changes in assumptions (130,093) (33,003)

Liability experience gain/(loss) arising during the year 204,230

Total actuarial gain/(loss) recognised in OCI (2,713,838)

An actuarial gain (the difference between expected and actual DBO as at the end of 2015) of €204,230

arose during the year due to the following factors:

• Change in financial assumptions: the equivalent discount rate has increased from 2.33% to 2.41%,

producing a gain of €117,557. The inflation and salary increase assumptions have both decreased

producing a gain of €216,766. Thus, the change in financial assumptions gives rise to an overall

actuarial gain of €334,323.

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

46 of 56