Page 91 - Annual Report 2015 EN

P. 91

Annual Report 2015

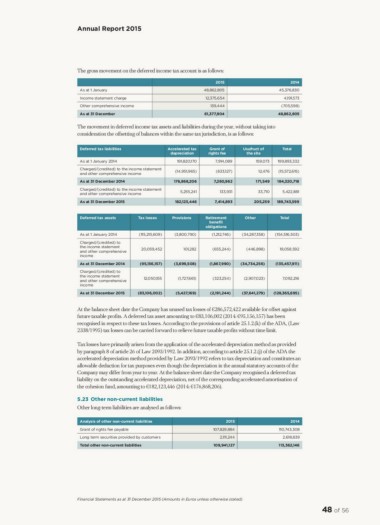

The gross movement on the deferred income tax account is as follows:

As at 1 January 2015 2014

Income statement charge 48,862,805 45,376,830

Other comprehensive income 12,375,654

As at 31 December 4,191,573

139,444 (705,598)

61,377,904 48,862,805

The movement in deferred income tax assets and liabilities during the year, without taking into

consideration the offsetting of balances within the same tax jurisdiction, is as follows:

Deferred tax liabilities Accelerated tax Grant of Usufruct of Total

depreciation rights fee the site 199,893,332

As at 1 January 2014 191,820,170

Charged/(credited) to the income statement 7,914,089 159,073

and other comprehensive income (14,951,965)

As at 31 December 2014 (633,127) 12,476 (15,572,615)

Charged/(credited) to the income statement 176,868,206

and other comprehensive income 7,280,962 171,549 184,320,718

As at 31 December 2015 5,255,241

133,931 33,710 5,422,881

182,123,446

7,414,893 205,259 189,743,599

Deferred tax assets Tax losses Provisions Retirement Other Total

(115,215,609) (3,800,790) bene t

As at 1 January 2014 (34,287,358) (154,516,503)

obligations

Charged/(credited) to

the income statement (1,212,746)

and other comprehensive

income 20,059,452 101,282 (655,244) (446,898) 19,058,592

As at 31 December 2014 (95,156,157) (3,699,508) (1,867,990) (34,734,256) (135,457,911)

Charged/(credited) to 12,050,155 (1,727,661) (323,254) (2,907,023) 7,092,216

the income statement

and other comprehensive (83,106,002) (5,427,169) (2,191,244) (37,641,279) (128,365,695)

income

As at 31 December 2015

At the balance sheet date the Company has unused tax losses of €286,572,422 available for offset against

future taxable profits. A deferred tax asset amounting to €83,106,002 (2014: €95,156,157) has been

recognised in respect to these tax losses. According to the provisions of article 25.1.2.(k) of the ADA, (Law

2338/1995) tax losses can be carried forward to relieve future taxable profits without time limit.

Tax losses have primarily arisen from the application of the accelerated depreciation method as provided

by paragraph 8 of article 26 of Law 2093/1992. In addition, according to article 25.1.2.(j) of the ADA the

accelerated depreciation method provided by Law 2093/1992 refers to tax depreciation and constitutes an

allowable deduction for tax purposes even though the depreciation in the annual statutory accounts of the

Company may differ from year to year. At the balance sheet date the Company recognised a deferred tax

liability on the outstanding accelerated depreciation, net of the corresponding accelerated amortisation of

the cohesion fund, amounting to €182,123,446 (2014: €176,868,206).

5.23 Other non-current liabilities

Other long-term liabilities are analysed as follows:

Analysis of other non-current liabilities 2015 2014

Grant of rights fee payable 107,829,884 110,743,308

Long term securities provided by customers

Total other non-current liabilities 2,111,244 2,618,839

109,941,127 113,362,146

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

48 of 56

The gross movement on the deferred income tax account is as follows:

As at 1 January 2015 2014

Income statement charge 48,862,805 45,376,830

Other comprehensive income 12,375,654

As at 31 December 4,191,573

139,444 (705,598)

61,377,904 48,862,805

The movement in deferred income tax assets and liabilities during the year, without taking into

consideration the offsetting of balances within the same tax jurisdiction, is as follows:

Deferred tax liabilities Accelerated tax Grant of Usufruct of Total

depreciation rights fee the site 199,893,332

As at 1 January 2014 191,820,170

Charged/(credited) to the income statement 7,914,089 159,073

and other comprehensive income (14,951,965)

As at 31 December 2014 (633,127) 12,476 (15,572,615)

Charged/(credited) to the income statement 176,868,206

and other comprehensive income 7,280,962 171,549 184,320,718

As at 31 December 2015 5,255,241

133,931 33,710 5,422,881

182,123,446

7,414,893 205,259 189,743,599

Deferred tax assets Tax losses Provisions Retirement Other Total

(115,215,609) (3,800,790) bene t

As at 1 January 2014 (34,287,358) (154,516,503)

obligations

Charged/(credited) to

the income statement (1,212,746)

and other comprehensive

income 20,059,452 101,282 (655,244) (446,898) 19,058,592

As at 31 December 2014 (95,156,157) (3,699,508) (1,867,990) (34,734,256) (135,457,911)

Charged/(credited) to 12,050,155 (1,727,661) (323,254) (2,907,023) 7,092,216

the income statement

and other comprehensive (83,106,002) (5,427,169) (2,191,244) (37,641,279) (128,365,695)

income

As at 31 December 2015

At the balance sheet date the Company has unused tax losses of €286,572,422 available for offset against

future taxable profits. A deferred tax asset amounting to €83,106,002 (2014: €95,156,157) has been

recognised in respect to these tax losses. According to the provisions of article 25.1.2.(k) of the ADA, (Law

2338/1995) tax losses can be carried forward to relieve future taxable profits without time limit.

Tax losses have primarily arisen from the application of the accelerated depreciation method as provided

by paragraph 8 of article 26 of Law 2093/1992. In addition, according to article 25.1.2.(j) of the ADA the

accelerated depreciation method provided by Law 2093/1992 refers to tax depreciation and constitutes an

allowable deduction for tax purposes even though the depreciation in the annual statutory accounts of the

Company may differ from year to year. At the balance sheet date the Company recognised a deferred tax

liability on the outstanding accelerated depreciation, net of the corresponding accelerated amortisation of

the cohesion fund, amounting to €182,123,446 (2014: €176,868,206).

5.23 Other non-current liabilities

Other long-term liabilities are analysed as follows:

Analysis of other non-current liabilities 2015 2014

Grant of rights fee payable 107,829,884 110,743,308

Long term securities provided by customers

Total other non-current liabilities 2,111,244 2,618,839

109,941,127 113,362,146

Financial Statements as at 31 December 2015 (Amounts in Euros unless otherwise stated)

48 of 56