Page 17 - exofilo_gr

P. 17

CORPORAT E

RE S P ONS I BI L I T Y

REPORT 201 2

3.1 ECONOMIC FIGURES

Total Revenues 2012 2011

Stated in €mio. 338.8 379.5

120.6 130.3

Total Operating Expenses 218.2 249.1

Stated in €mio 64.4% 65.7%

1,287.6 1,395.8

EBITDA 51.2 71.6

Stated in €mio. EBITDA plus subsidies. 111.0 75.0

-38.1 23.7

EBITDA margin % 27.8 50.0

EBITDA plus subsidies / Total revenues

106.7 152.3

Total Assets

Stated in €mio 2.50% 2.58%

Added Value on Assets

Stated in €mio. AVA: Added Value on Assets = Net Operating Profit after Tax - Cost of Capital x Net Asset Value

Dividends

Stated in €mio. Amounts relating to previous Financial Year with the outflow occuring in the current year

Change in Retained Earnings

Stated in €mio

Income & Other Taxes

Stated in €mio. Amounts relating to previous financial year with the outflow occuring in the current year

Social Product

Stated in €mio. Social Product is the total valuation of amounts paid for AIA payroll, contracted services payroll, social

security contribution, income/municipality/other tax, corporate responsibility opex, environmental and safety-related

capex. Includes provisions.

Corporate Responsibility % OpEx

Corporate Responsibility as % of total OpEx. Corporate Responsibility is the total valuation of activities relating to

environmental, local community, art&culture, other social contribution, employee benefits & engagement, safety and

CR management.

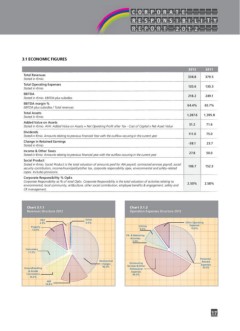

Chart 3.1.1 Chart 3.1.2

Revenues Structure 2012 Operation Expenses Structure 2012

IT&T Other Other Operating

2.3% 0.5% Expenses

Property 10.0%

13.0% Utilities

9.0%

P.R. & Marketing

Activities

2.0%

Consumers

17.2%

Groundhandling Aeronautical Outsourcing Personnel

& Airside Charges Services & Other Related

40.2% Expenses

Concessions Professional 33.0%

10.2% Expenses

46.0%

ADF

16.6%

17

RE S P ONS I BI L I T Y

REPORT 201 2

3.1 ECONOMIC FIGURES

Total Revenues 2012 2011

Stated in €mio. 338.8 379.5

120.6 130.3

Total Operating Expenses 218.2 249.1

Stated in €mio 64.4% 65.7%

1,287.6 1,395.8

EBITDA 51.2 71.6

Stated in €mio. EBITDA plus subsidies. 111.0 75.0

-38.1 23.7

EBITDA margin % 27.8 50.0

EBITDA plus subsidies / Total revenues

106.7 152.3

Total Assets

Stated in €mio 2.50% 2.58%

Added Value on Assets

Stated in €mio. AVA: Added Value on Assets = Net Operating Profit after Tax - Cost of Capital x Net Asset Value

Dividends

Stated in €mio. Amounts relating to previous Financial Year with the outflow occuring in the current year

Change in Retained Earnings

Stated in €mio

Income & Other Taxes

Stated in €mio. Amounts relating to previous financial year with the outflow occuring in the current year

Social Product

Stated in €mio. Social Product is the total valuation of amounts paid for AIA payroll, contracted services payroll, social

security contribution, income/municipality/other tax, corporate responsibility opex, environmental and safety-related

capex. Includes provisions.

Corporate Responsibility % OpEx

Corporate Responsibility as % of total OpEx. Corporate Responsibility is the total valuation of activities relating to

environmental, local community, art&culture, other social contribution, employee benefits & engagement, safety and

CR management.

Chart 3.1.1 Chart 3.1.2

Revenues Structure 2012 Operation Expenses Structure 2012

IT&T Other Other Operating

2.3% 0.5% Expenses

Property 10.0%

13.0% Utilities

9.0%

P.R. & Marketing

Activities

2.0%

Consumers

17.2%

Groundhandling Aeronautical Outsourcing Personnel

& Airside Charges Services & Other Related

40.2% Expenses

Concessions Professional 33.0%

10.2% Expenses

46.0%

ADF

16.6%

17