Page 27 - Annual Report 2015 EN

P. 27

Annual Report 2015

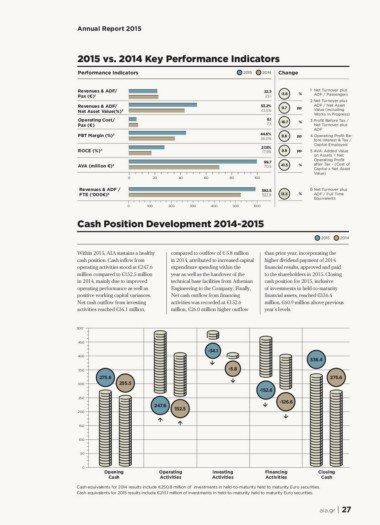

2015 vs. 2014 Key Performance Indicators

Performance Indicators 2015 2014 Change

Revenues & ADF/ 22.3 -3.6 1 Net Turnover plus

Pax (€)1 23.1 % ADF / Passengers

Revenues & ADF/

Net Asset Value(%)2 2 Net Turnover plus

Operating Cost/

Pax (€) 53.2% 9.7 pp ADF / Net Asset

PBT Margin (%)3 43.5% Value (including

Works In Progress)

ROCE (%)4

6.1 -16.7 % 3 Pro t Before Tax /

AVA (million €)5 7.3 Net Turnover plus

0 ADF

Revenues & ADF / 44.6% 8.6 pp 4 Operating Pro t Be-

FTE (‘000€)6 36.0% fore Interest & Tax /

0 27.8% Capital Employed

17.9% 9.9 pp 5 AVA: Added Value

on Assets = Net

99.7 41.5 % Operating Pro t

70.5 after Tax – (Cost of

Capital x Net Asset

Value)

20 40 60 80 100

592.5 13.3 6 Net Turnover plus

522.9 % ADF / Full Time

600 Equivalents

100 200 300 400 500

Cash Position Development 2014-2015

2015 2014

Within 2015, AIA sustains a healthy compared to outlfow of € 5.8 million than prior year, incorporating the

cash position. Cash inflow from in 2014, attributed to increased capital higher dividend payment of 2014

operating activities stood at €247.6 expenditure spending within the financial results, approved and paid

million compared to €152.5 million year as well as the handover of the to the shareholders in 2015. Closing

in 2014, mainly due to improved technical base facilities from Athenian cash position for 2015, inclusive

operating performance as well as Engineering to the Company. Finally, of investments in held-to-maturity

positive working capital variances. Net cash outflow from financing financial assets, reached €336.4

Net cash outflow from investing activities was recorded at €152.6 million, €60.9 million above previous

activities reached €34.1 million, million, €26.0 million higher outflow year’s levels.

500*

450 -34.1 336.4

-5.8 275.6

400

247.6 152.5 -152.6

350 -126.6

275.6

300 255.5

250

200

150

100

50

0 Operating Investing Financing Closing

Activities Activities Activities Cash

Opening

Cash

Cash equivalents for 2014 results include €250.8 million of investments in held-to-maturity held to maturity Euro securities.

Cash equivalents for 2015 results include €213.1 million of investments in held-to-maturity held to maturity Euro securities.

aia.gr | 27

2015 vs. 2014 Key Performance Indicators

Performance Indicators 2015 2014 Change

Revenues & ADF/ 22.3 -3.6 1 Net Turnover plus

Pax (€)1 23.1 % ADF / Passengers

Revenues & ADF/

Net Asset Value(%)2 2 Net Turnover plus

Operating Cost/

Pax (€) 53.2% 9.7 pp ADF / Net Asset

PBT Margin (%)3 43.5% Value (including

Works In Progress)

ROCE (%)4

6.1 -16.7 % 3 Pro t Before Tax /

AVA (million €)5 7.3 Net Turnover plus

0 ADF

Revenues & ADF / 44.6% 8.6 pp 4 Operating Pro t Be-

FTE (‘000€)6 36.0% fore Interest & Tax /

0 27.8% Capital Employed

17.9% 9.9 pp 5 AVA: Added Value

on Assets = Net

99.7 41.5 % Operating Pro t

70.5 after Tax – (Cost of

Capital x Net Asset

Value)

20 40 60 80 100

592.5 13.3 6 Net Turnover plus

522.9 % ADF / Full Time

600 Equivalents

100 200 300 400 500

Cash Position Development 2014-2015

2015 2014

Within 2015, AIA sustains a healthy compared to outlfow of € 5.8 million than prior year, incorporating the

cash position. Cash inflow from in 2014, attributed to increased capital higher dividend payment of 2014

operating activities stood at €247.6 expenditure spending within the financial results, approved and paid

million compared to €152.5 million year as well as the handover of the to the shareholders in 2015. Closing

in 2014, mainly due to improved technical base facilities from Athenian cash position for 2015, inclusive

operating performance as well as Engineering to the Company. Finally, of investments in held-to-maturity

positive working capital variances. Net cash outflow from financing financial assets, reached €336.4

Net cash outflow from investing activities was recorded at €152.6 million, €60.9 million above previous

activities reached €34.1 million, million, €26.0 million higher outflow year’s levels.

500*

450 -34.1 336.4

-5.8 275.6

400

247.6 152.5 -152.6

350 -126.6

275.6

300 255.5

250

200

150

100

50

0 Operating Investing Financing Closing

Activities Activities Activities Cash

Opening

Cash

Cash equivalents for 2014 results include €250.8 million of investments in held-to-maturity held to maturity Euro securities.

Cash equivalents for 2015 results include €213.1 million of investments in held-to-maturity held to maturity Euro securities.

aia.gr | 27