Page 26 - Annual Report 2015 EN

P. 26

4 Financial Performance

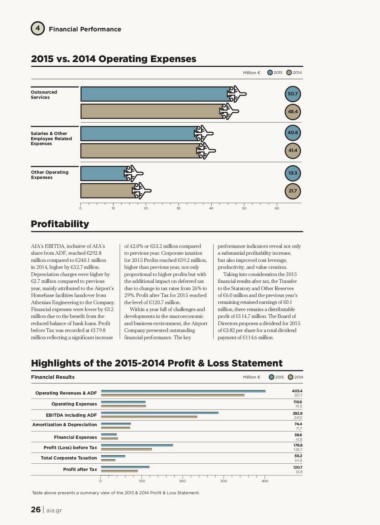

2015 vs. 2014 Operating Expenses Million € 2015 2014

Outsourced 50.7

Services 48.4

Salaries & Other 40.6

Employee Related 41.4

Expenses

Other Operating 19.3

Expenses 21.7

0 10 20 30 40 50 60

Pro tability

AIA’s EBITDA, inclusive of AIA’s of 42.0% or €53.2 million compared performance indicators reveal not only

share from ADF, reached €292.8 to previous year. Corporate taxation a substantial profitability increase,

million compared to €240.1 million for 2015 Profits reached €59.2 million, but also improved cost leverage,

in 2014, higher by €52.7 million. higher than previous year, not only productivity, and value creation.

Depreciation charges were higher by proportional to higher profits but with

€2.7 million compared to previous the additional impact on deferred tax Taking into consideration the 2015

year, mainly attributed to the Airport’s due to change in tax rates from 26% to financial results after tax, the Transfer

Homebase facilities handover from 29%. Profit after Tax for 2015 reached to the Statutory and Other Reserves

Athenian Engineering to the Company. the level of €120.7 million. of €6.0 million and the previous year’s

Financial expenses were lower by €3.2 remaining retained earnings of €0.1

million due to the benefit from the Within a year full of challenges and million, there remains a distributable

reduced balance of bank loans. Profit developments in the macroeconomic profit of €114.7 million. The Board of

before Tax was recorded at €179.8 and business environment, the Airport Directors proposes a dividend for 2015

million reflecting a significant increase Company presented outstanding of €3.82 per share for a total dividend

financial performance. The key payment of €114.6 million.

Highlights of the 2015-2014 Pro t & Loss Statement

Financial Results Million € 2015 2014

Operating Revenues & ADF 300 403.4

Operating Expenses 351.7

EBITDA including ADF 110.6

Amortization & Depreciation 111.5

Financial Expenses 292.8

Pro t (Loss) before Tax 240.1

Total Corporate Taxation

74.4

Pro t after Tax 71.7

0 100 200 38.6

41.8

Table above presents a summary view of the 2015 & 2014 Pro t & Loss Statement. 179.8

126.7

59.2

34.9

120.7

91.8

400

26 | aia.gr

2015 vs. 2014 Operating Expenses Million € 2015 2014

Outsourced 50.7

Services 48.4

Salaries & Other 40.6

Employee Related 41.4

Expenses

Other Operating 19.3

Expenses 21.7

0 10 20 30 40 50 60

Pro tability

AIA’s EBITDA, inclusive of AIA’s of 42.0% or €53.2 million compared performance indicators reveal not only

share from ADF, reached €292.8 to previous year. Corporate taxation a substantial profitability increase,

million compared to €240.1 million for 2015 Profits reached €59.2 million, but also improved cost leverage,

in 2014, higher by €52.7 million. higher than previous year, not only productivity, and value creation.

Depreciation charges were higher by proportional to higher profits but with

€2.7 million compared to previous the additional impact on deferred tax Taking into consideration the 2015

year, mainly attributed to the Airport’s due to change in tax rates from 26% to financial results after tax, the Transfer

Homebase facilities handover from 29%. Profit after Tax for 2015 reached to the Statutory and Other Reserves

Athenian Engineering to the Company. the level of €120.7 million. of €6.0 million and the previous year’s

Financial expenses were lower by €3.2 remaining retained earnings of €0.1

million due to the benefit from the Within a year full of challenges and million, there remains a distributable

reduced balance of bank loans. Profit developments in the macroeconomic profit of €114.7 million. The Board of

before Tax was recorded at €179.8 and business environment, the Airport Directors proposes a dividend for 2015

million reflecting a significant increase Company presented outstanding of €3.82 per share for a total dividend

financial performance. The key payment of €114.6 million.

Highlights of the 2015-2014 Pro t & Loss Statement

Financial Results Million € 2015 2014

Operating Revenues & ADF 300 403.4

Operating Expenses 351.7

EBITDA including ADF 110.6

Amortization & Depreciation 111.5

Financial Expenses 292.8

Pro t (Loss) before Tax 240.1

Total Corporate Taxation

74.4

Pro t after Tax 71.7

0 100 200 38.6

41.8

Table above presents a summary view of the 2015 & 2014 Pro t & Loss Statement. 179.8

126.7

59.2

34.9

120.7

91.8

400

26 | aia.gr