Page 25 - Annual Report 2015 EN

P. 25

Annual Report 2015

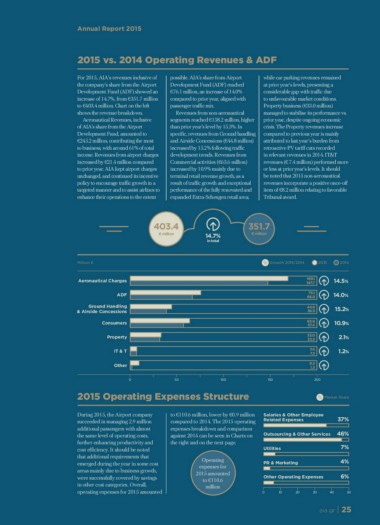

2015 vs. 2014 Operating Revenues & ADF

For 2015, AIA’s revenues inclusive of possible. AIA’s share from Airport while car parking revenues remained

the company’s share from the Airport Development Fund (ADF) reached at prior year’s levels, presenting a

Development Fund (ADF) showed an €76.1 million, an increase of 14.0% considerable gap with traffic due

increase of 14.7%, from €351.7 million compared to prior year, aligned with to unfavourable market conditions.

to €403.4 million. Chart on the left passenger traffic mix. Property business (€33.0 million)

shows the revenue breakdown. managed to stabilise its performance vs.

Revenues from non-aeronautical prior year, despite ongoing economic

Aeronautical Revenues, inclusive segments reached €158.2 million, higher crisis. The Property revenues increase

of AIA’s share from the Airport than prior year’s level by 15.3%. In compared to previous year is mainly

Development Fund, amounted to specific, revenues from Ground handling attributed to last year’s burden from

€245.2 million, contributing the most and Airside Concessions (€44.8 million) retroactive PV tariff cuts recorded

to business, with around 61% of total increased by 15.2% following traffic in relevant revenues in 2014. IT&T

income. Revenues from airport charges development trends. Revenues from revenues (€ 7.4 million) performed more

increased by €21.4 million compared Commercial activities (€63.6 million) or less at prior year’s levels. It should

to prior year. AIA kept airport charges increased by 10.9% mainly due to be noted that 2015 non-aeronautical

unchanged, and continued its incentive terminal retail revenue growth, as a revenues incorporate a positive once-off

policy to encourage traffic growth in a result of traffic growth and exceptional item of €8.2 million relating to favorable

targeted manner and to assist airlines to performance of the fully renovated and Tribunal award.

enhance their operations to the extent expanded Extra-Schengen retail area;

403.4 14.7% 351.7

€ million in total € million

Million € Growth 2015/2014 2015 2014

Aeronautical Charges 169.1 14.5%

ADF 147.7 14.0%

15.2%

Ground Handling 76.1 10.9%

& Airside Concessions 66.8

44.8 2.1%

Consumers 38.9 1.2%

Property 63.6

IT & T 150 57.4

Other 33.0

32.3

0 50 100

7.4

2015 Operating Expenses Structure 7.3

9.3

1.3

200

Market Share

During 2015, the Airport company to €110.6 million, lower by €0.9 million Salaries & Other Employee 37%

succeeded in managing 2.9 million compared to 2014. The 2015 operating Related Expenses

additional passengers with almost expenses breakdown and comparison

the same level of operating costs, against 2014 can be seen in Charts on Outsourcing & Other Services 46%

further enhancing productivity and the right and on the next page.

cost efficiency. It should be noted 7%

that additional requirements that Utilities

emerged during the year in some cost

areas mainly due to business growth, Operating PR & Marketing 4%

were successfully covered by savings expenses for Other Operating Expenses 6%

in other cost categories. Overall, 2015 amounted

operating expenses for 2015 amounted

to €110.6

million

0 10 20 30 40 50

aia.gr | 25

2015 vs. 2014 Operating Revenues & ADF

For 2015, AIA’s revenues inclusive of possible. AIA’s share from Airport while car parking revenues remained

the company’s share from the Airport Development Fund (ADF) reached at prior year’s levels, presenting a

Development Fund (ADF) showed an €76.1 million, an increase of 14.0% considerable gap with traffic due

increase of 14.7%, from €351.7 million compared to prior year, aligned with to unfavourable market conditions.

to €403.4 million. Chart on the left passenger traffic mix. Property business (€33.0 million)

shows the revenue breakdown. managed to stabilise its performance vs.

Revenues from non-aeronautical prior year, despite ongoing economic

Aeronautical Revenues, inclusive segments reached €158.2 million, higher crisis. The Property revenues increase

of AIA’s share from the Airport than prior year’s level by 15.3%. In compared to previous year is mainly

Development Fund, amounted to specific, revenues from Ground handling attributed to last year’s burden from

€245.2 million, contributing the most and Airside Concessions (€44.8 million) retroactive PV tariff cuts recorded

to business, with around 61% of total increased by 15.2% following traffic in relevant revenues in 2014. IT&T

income. Revenues from airport charges development trends. Revenues from revenues (€ 7.4 million) performed more

increased by €21.4 million compared Commercial activities (€63.6 million) or less at prior year’s levels. It should

to prior year. AIA kept airport charges increased by 10.9% mainly due to be noted that 2015 non-aeronautical

unchanged, and continued its incentive terminal retail revenue growth, as a revenues incorporate a positive once-off

policy to encourage traffic growth in a result of traffic growth and exceptional item of €8.2 million relating to favorable

targeted manner and to assist airlines to performance of the fully renovated and Tribunal award.

enhance their operations to the extent expanded Extra-Schengen retail area;

403.4 14.7% 351.7

€ million in total € million

Million € Growth 2015/2014 2015 2014

Aeronautical Charges 169.1 14.5%

ADF 147.7 14.0%

15.2%

Ground Handling 76.1 10.9%

& Airside Concessions 66.8

44.8 2.1%

Consumers 38.9 1.2%

Property 63.6

IT & T 150 57.4

Other 33.0

32.3

0 50 100

7.4

2015 Operating Expenses Structure 7.3

9.3

1.3

200

Market Share

During 2015, the Airport company to €110.6 million, lower by €0.9 million Salaries & Other Employee 37%

succeeded in managing 2.9 million compared to 2014. The 2015 operating Related Expenses

additional passengers with almost expenses breakdown and comparison

the same level of operating costs, against 2014 can be seen in Charts on Outsourcing & Other Services 46%

further enhancing productivity and the right and on the next page.

cost efficiency. It should be noted 7%

that additional requirements that Utilities

emerged during the year in some cost

areas mainly due to business growth, Operating PR & Marketing 4%

were successfully covered by savings expenses for Other Operating Expenses 6%

in other cost categories. Overall, 2015 amounted

operating expenses for 2015 amounted

to €110.6

million

0 10 20 30 40 50

aia.gr | 25