Page 78 - 2board23full

P. 78

Financial Statements

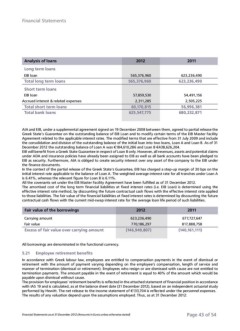

Analysis of loans 2012 2011

Long term loans 565,376,960 623,236,490

EIB loan 565,376,960 623,236,490

Total long term loans 57,859,530 54,491,156

2,311,285 2,505,225

Short term loans

60,170,815 56,996,381

EIB loan 625,547,775 680,232,871

Accrued interest & related expenses

Total short term loans

Total bank loans

AIA and EIB, under a supplemental agreement signed on 19 December 2008 between them, agreed to partial release the

Greek State’s Guarantee on the outstanding balance of EIB Loan and to modify certain terms of the EIB Master Facility

Agreement related to the applicable interest rates. The modified terms that are effective from 31 July 2009 and include

the consolidation and division of the outstanding balance of the initial loan into two loans, Loan A and Loan B. As of 31

December 2012 the outstanding balance of Loan A was €184,610,286 and Loan B €438,626,204.

EIB will benefit from a Greek State Guarantee in respect of Loan B only. However, all revenues, assets and potential claims

under ADA and insurance policies have already been assigned to EIB as well as all bank accounts have been pledged to

EIB as security. Furthermore, AIA is obliged to create security interest over any asset of the company to the EIB under

the finance documents.

In the context of the partial release of the Greek State’s Guarantee, EIB has charged a step-up margin of 30 bps on the

initial interest rate applicable to the balance of Loan A. The weighted average interest rate for all tranches under Loan A

is 6.41%, whereas the relevant figure for Loan B is 6.11%.

All the covenants set under the EIB Master Facility Agreement have been fulfilled as of 31 December 2012.

The amortised cost of the long term financial liabilities at fixed interest rates (i.e. EIB Loan) is determined using the

effective interest rate method, by discounting the future contractual cash flows with the effective interest rate applied

to those liabilities. The fair value of the financial liabilities at fixed interest rates is determined by discounting the future

contractual cash flows with the current mid-swap interest rate for the average loan life period of such liabilities.

Fair value of the borrowings 2012 2011

Carrying amount 623,236,490 677,727,647

Fair value 770,186,297 817,888,758

Excess of fair value over carrying amount (146,949,807) (140,161,111)

All borrowings are denominated in the functional currency.

5.21 Employee retirement benefits

In accordance with Greek labour law, employees are entitled to compensation payments in the event of dismissal or

retirement with the amount of payment varying depending on the employee’s compensation, length of service and

manner of termination (dismissal or retirement). Employees who resign or are dismissed with cause are not entitled to

termination payments. The amount payable in the event of retirement is equal to 40% of the amount which would be

payable upon dismissal without cause.

The provision for employees’ retirement benefits is reflected in the attached statement of financial position in accordance

with IAS 19 and is calculated, as at the balance sheet date (31 December 2012), based on an independent actuarial study

performed by Hewitt. The net release to the income statement of €133,704 is reflected under the personnel expenses.

The results of any valuation depend upon the assumptions employed. Thus, as at 31 December 2012:

Financial Statements as at 31 December 2012 (Amounts in Euros unless otherwise stated) Page 43 of 54

Analysis of loans 2012 2011

Long term loans 565,376,960 623,236,490

EIB loan 565,376,960 623,236,490

Total long term loans 57,859,530 54,491,156

2,311,285 2,505,225

Short term loans

60,170,815 56,996,381

EIB loan 625,547,775 680,232,871

Accrued interest & related expenses

Total short term loans

Total bank loans

AIA and EIB, under a supplemental agreement signed on 19 December 2008 between them, agreed to partial release the

Greek State’s Guarantee on the outstanding balance of EIB Loan and to modify certain terms of the EIB Master Facility

Agreement related to the applicable interest rates. The modified terms that are effective from 31 July 2009 and include

the consolidation and division of the outstanding balance of the initial loan into two loans, Loan A and Loan B. As of 31

December 2012 the outstanding balance of Loan A was €184,610,286 and Loan B €438,626,204.

EIB will benefit from a Greek State Guarantee in respect of Loan B only. However, all revenues, assets and potential claims

under ADA and insurance policies have already been assigned to EIB as well as all bank accounts have been pledged to

EIB as security. Furthermore, AIA is obliged to create security interest over any asset of the company to the EIB under

the finance documents.

In the context of the partial release of the Greek State’s Guarantee, EIB has charged a step-up margin of 30 bps on the

initial interest rate applicable to the balance of Loan A. The weighted average interest rate for all tranches under Loan A

is 6.41%, whereas the relevant figure for Loan B is 6.11%.

All the covenants set under the EIB Master Facility Agreement have been fulfilled as of 31 December 2012.

The amortised cost of the long term financial liabilities at fixed interest rates (i.e. EIB Loan) is determined using the

effective interest rate method, by discounting the future contractual cash flows with the effective interest rate applied

to those liabilities. The fair value of the financial liabilities at fixed interest rates is determined by discounting the future

contractual cash flows with the current mid-swap interest rate for the average loan life period of such liabilities.

Fair value of the borrowings 2012 2011

Carrying amount 623,236,490 677,727,647

Fair value 770,186,297 817,888,758

Excess of fair value over carrying amount (146,949,807) (140,161,111)

All borrowings are denominated in the functional currency.

5.21 Employee retirement benefits

In accordance with Greek labour law, employees are entitled to compensation payments in the event of dismissal or

retirement with the amount of payment varying depending on the employee’s compensation, length of service and

manner of termination (dismissal or retirement). Employees who resign or are dismissed with cause are not entitled to

termination payments. The amount payable in the event of retirement is equal to 40% of the amount which would be

payable upon dismissal without cause.

The provision for employees’ retirement benefits is reflected in the attached statement of financial position in accordance

with IAS 19 and is calculated, as at the balance sheet date (31 December 2012), based on an independent actuarial study

performed by Hewitt. The net release to the income statement of €133,704 is reflected under the personnel expenses.

The results of any valuation depend upon the assumptions employed. Thus, as at 31 December 2012:

Financial Statements as at 31 December 2012 (Amounts in Euros unless otherwise stated) Page 43 of 54