Page 83 - 2board23full

P. 83

Advance payments from customers represent the prepayments effected by the airlines which have selected the “Rolling

prepayment” method in settling their financial obligations to the Company for the use of the airport facilities.

In year 2012 an amount of €12.3m given by an airline remaining pending at 2011 year end was fully settled with its

overdue financial obligations.

Beneficiaries of money – guarantees represent the cash guarantees provided by the concessionaires for the prompt fulfilment

of their financial liabilities arising from the signed concessions agreements. The cash guarantees are adjusted each year in

accordance with the latest estimate of the expected sales forecast of the concessionaires for the subsequent year.

The carrying amount of trade payables closely approximates their fair value at balance sheet date.

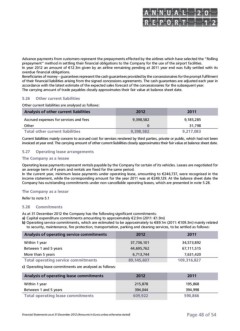

5.26 Other current liabilities 2012 2011

Other current liabilities are analysed as follows:

Analysis of other current liabilities

Accrued expenses for services and fees 9,398,582 9,185,285

Other 0 31,798

Total other current liabilities 9,398,582 9,217,083

Current liabilities mainly concern to accrued cost for services rendered by third parties, private or public, which had not been

invoiced at year end. The carrying amount of other current liabilities closely approximates their fair value at balance sheet date.

5.27 Operating lease arrangements

The Company as a lessee

Operating lease payments represent rentals payable by the Company for certain of its vehicles. Leases are negotiated for

an average term of 4 years and rentals are fixed for the same period.

In the current year, minimum lease payments under operating lease, amounting to €246,737, were recognised in the

income statement, while the corresponding amount for the year 2011 was at €249,129. At the balance sheet date the

Company has outstanding commitments under non-cancellable operating leases, which are presented in note 5.28.

The Company as a lessor

Refer to note 5.1

5.28 Commitments

As at 31 December 2012 the Company has the following significant commitments:

a) Capital expenditure commitments amounting to approximately €2.9m (2011: €1.9m)

b) Operating service commitments, which are estimated to be approximately to €89.1m (2011: €109.3m) mainly related

to security, maintenance, fire protection, transportation, parking and cleaning services, to be settled as follows:

Analysis of operating service commitments 2012 2011

Within 1 year 37,736,101 34,573,892

Between 1 and 5 years 44,695,762 67,111,515

More than 5 years

6,713,744 7,631,420

Total operating service commitments

89,145,607 109,316,827

c) Operating lease commitments are analysed as follows:

Analysis of operating lease commitments 2012 2011

Within 1 year 215,878 195,868

Between 1 and 5 years 394,044 394,998

Total operating lease commitments 609,922 590,866

Financial Statements as at 31 December 2012 (Amounts in Euros unless otherwise stated) Page 48 of 54

prepayment” method in settling their financial obligations to the Company for the use of the airport facilities.

In year 2012 an amount of €12.3m given by an airline remaining pending at 2011 year end was fully settled with its

overdue financial obligations.

Beneficiaries of money – guarantees represent the cash guarantees provided by the concessionaires for the prompt fulfilment

of their financial liabilities arising from the signed concessions agreements. The cash guarantees are adjusted each year in

accordance with the latest estimate of the expected sales forecast of the concessionaires for the subsequent year.

The carrying amount of trade payables closely approximates their fair value at balance sheet date.

5.26 Other current liabilities 2012 2011

Other current liabilities are analysed as follows:

Analysis of other current liabilities

Accrued expenses for services and fees 9,398,582 9,185,285

Other 0 31,798

Total other current liabilities 9,398,582 9,217,083

Current liabilities mainly concern to accrued cost for services rendered by third parties, private or public, which had not been

invoiced at year end. The carrying amount of other current liabilities closely approximates their fair value at balance sheet date.

5.27 Operating lease arrangements

The Company as a lessee

Operating lease payments represent rentals payable by the Company for certain of its vehicles. Leases are negotiated for

an average term of 4 years and rentals are fixed for the same period.

In the current year, minimum lease payments under operating lease, amounting to €246,737, were recognised in the

income statement, while the corresponding amount for the year 2011 was at €249,129. At the balance sheet date the

Company has outstanding commitments under non-cancellable operating leases, which are presented in note 5.28.

The Company as a lessor

Refer to note 5.1

5.28 Commitments

As at 31 December 2012 the Company has the following significant commitments:

a) Capital expenditure commitments amounting to approximately €2.9m (2011: €1.9m)

b) Operating service commitments, which are estimated to be approximately to €89.1m (2011: €109.3m) mainly related

to security, maintenance, fire protection, transportation, parking and cleaning services, to be settled as follows:

Analysis of operating service commitments 2012 2011

Within 1 year 37,736,101 34,573,892

Between 1 and 5 years 44,695,762 67,111,515

More than 5 years

6,713,744 7,631,420

Total operating service commitments

89,145,607 109,316,827

c) Operating lease commitments are analysed as follows:

Analysis of operating lease commitments 2012 2011

Within 1 year 215,878 195,868

Between 1 and 5 years 394,044 394,998

Total operating lease commitments 609,922 590,866

Financial Statements as at 31 December 2012 (Amounts in Euros unless otherwise stated) Page 48 of 54