Page 77 - 2board23full

P. 77

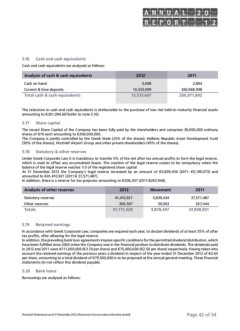

5.16 Cash and cash equivalents 2012 2011

Cash and cash equivalents are analysed as follows:

3,698 2,894

Analysis of cash & cash equivalents 13,533,909 266,968,998

Cash on hand 13,537,607 266,971,892

Current & time deposits

Total cash & cash equivalents

The reduction in cash and cash equivalents is attributable to the purchase of low risk held-to-maturity financial assets

amounting to €201,094,607(refer to note 5.10).

5.17 Share capital

The issued Share Capital of the Company has been fully paid by the shareholders and comprises 30,000,000 ordinary

shares of €10 each amounting to €300,000,000.

The Company is jointly controlled by the Greek State (25% of the shares), Hellenic Republic Asset Development Fund

(30% of the shares), Hochtief Airport Group and other private shareholders (45% of the shares).

5.18 Statutory & other reserves

Under Greek Corporate Law it is mandatory to transfer 5% of the net after tax annual profits to form the legal reserve,

which is used to offset any accumulated losses. The creation of the legal reserve ceases to be compulsory when the

balance of the legal reserve reaches 1/3 of the registered share capital.

At 31 December 2012 the Company’s legal reserve increased by an amount of €3,839,434 (2011: €5,199,073) and

amounted to €41,410,921 (2011:€ 37,571,487).

In addition, there is a reserve for tax purposes amounting to €306,507 (2011:€267,444).

Analysis of other reserves 2012 Movement 2011

Statutory reserves 41,410,921 3,839,434 37,571,487

Other reserves 306,507 39,063 267,444

Totals 41,717,428 3,878,497 37,838,931

5.19 Retained earnings

In accordance with Greek Corporate Law, companies are required each year, to declare dividends of at least 35% of after

tax profits, after allowing for the legal reserve.

In addition, the prevailing bank loan agreements impose specific conditions for the permitted dividend distribution, which

have been fulfilled since 2003 when the Company was in the financial position to distribute dividends. The dividends paid

in 2012 and 2011 were €111,000,000 (€3.70 per share) and €75,000,000 (€2.50 per share) respectively. Having taken into

account the retained earnings of the previous years a dividend in respect of the year ended 31 December 2012 of €2.65

per share, amounting to a total dividend of €79,500,000 is to be proposed at the annual general meeting. These financial

statements do not reflect this dividend payable.

5.20 Bank loans

Borrowings are analysed as follows:

Financial Statements as at 31 December 2012 (Amounts in Euros unless otherwise stated) Page 42 of 54

Cash and cash equivalents are analysed as follows:

3,698 2,894

Analysis of cash & cash equivalents 13,533,909 266,968,998

Cash on hand 13,537,607 266,971,892

Current & time deposits

Total cash & cash equivalents

The reduction in cash and cash equivalents is attributable to the purchase of low risk held-to-maturity financial assets

amounting to €201,094,607(refer to note 5.10).

5.17 Share capital

The issued Share Capital of the Company has been fully paid by the shareholders and comprises 30,000,000 ordinary

shares of €10 each amounting to €300,000,000.

The Company is jointly controlled by the Greek State (25% of the shares), Hellenic Republic Asset Development Fund

(30% of the shares), Hochtief Airport Group and other private shareholders (45% of the shares).

5.18 Statutory & other reserves

Under Greek Corporate Law it is mandatory to transfer 5% of the net after tax annual profits to form the legal reserve,

which is used to offset any accumulated losses. The creation of the legal reserve ceases to be compulsory when the

balance of the legal reserve reaches 1/3 of the registered share capital.

At 31 December 2012 the Company’s legal reserve increased by an amount of €3,839,434 (2011: €5,199,073) and

amounted to €41,410,921 (2011:€ 37,571,487).

In addition, there is a reserve for tax purposes amounting to €306,507 (2011:€267,444).

Analysis of other reserves 2012 Movement 2011

Statutory reserves 41,410,921 3,839,434 37,571,487

Other reserves 306,507 39,063 267,444

Totals 41,717,428 3,878,497 37,838,931

5.19 Retained earnings

In accordance with Greek Corporate Law, companies are required each year, to declare dividends of at least 35% of after

tax profits, after allowing for the legal reserve.

In addition, the prevailing bank loan agreements impose specific conditions for the permitted dividend distribution, which

have been fulfilled since 2003 when the Company was in the financial position to distribute dividends. The dividends paid

in 2012 and 2011 were €111,000,000 (€3.70 per share) and €75,000,000 (€2.50 per share) respectively. Having taken into

account the retained earnings of the previous years a dividend in respect of the year ended 31 December 2012 of €2.65

per share, amounting to a total dividend of €79,500,000 is to be proposed at the annual general meeting. These financial

statements do not reflect this dividend payable.

5.20 Bank loans

Borrowings are analysed as follows:

Financial Statements as at 31 December 2012 (Amounts in Euros unless otherwise stated) Page 42 of 54