Page 70 - 2board23full

P. 70

Financial Statements

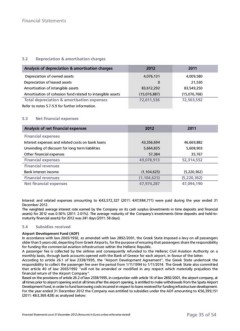

5.2 Depreciation & amortisation charges 2012 2011

Analysis of depreciation & amortisation charges 4,076,131 4,009,580

0 21,530

Depreciation of owned assets

Depreciation of leased assets 83,612,292 83,549,250

Amortisation of intangible assets (15,076,887) (15,076,768)

Amortisation of cohesion fund related to intangible assets

72,611,536 72,503,592

Total depreciation & amortisation expenses

2012 2011

Refer to notes 5.7-5.9 for further information.

43,356,694 46,669,882

5.3 Net financial expenses 5,664,835 5,608,903

57,384 35,767

Analysis of net financial expenses

49,078,913 52,314,552

Financial expenses

(1,104,625) (5,220,362)

Interest expenses and related costs on bank loans

Unwinding of discount for long term liabilities (1,104,625) (5,220,362)

Other financial expenses 47,974,287 47,094,190

Financial expenses

Financial revenues

Bank interest income

Financial revenues

Net financial expenses

Interest and related expenses amounting to €43,572,327 (2011: €47,984,771) were paid during the year ended 31

December 2012.

The weighted average interest rate earned by the Company on its cash surplus (investments in time deposits and financial

assets) for 2012 was 0.50% (2011: 2.01%). The average maturity of the Company’s investments (time deposits and held-to-

maturity financial assets) for 2012 was 241 days (2011: 58 days).

5.4 Subsidies received

Airport Development Fund (ADF)

In accordance with law 2065/1992, as amended with law 2892/2001, the Greek State imposed a levy on all passengers

older than 5 years old, departing from Greek Airports, for the purpose of ensuring that passengers share the responsibility

for funding the commercial aviation infrastructure within the Hellenic Republic.

A passenger fee is collected by the airlines and consequently refunded to the Hellenic Civil Aviation Authority on a

monthly basis, through bank accounts opened with the Bank of Greece for each airport, in favour of the latter.

According to article 26.1 of law 2338/1995, the “Airport Development Agreement”, the Greek State undertook the

responsibility to collect the passenger fee over the period from 1/11/1994 to 1/11/2014. The Greek State also committed

that article 40 of law 2065/1992 “will not be amended or modified in any respect which materially prejudices the

financial return of the Airport Company”.

Based on the provisions of article 26.2 of law 2338/1995, in conjunction with article 16 of law 2892/2001, the airport company, at

all times prior to airport opening and at all times after the airport opening, is entitled to make withdrawals from the Spata Airport

Development Fund, in order to fund borrowing costs incurred in respect to loans received for funding infrastructure development.

For the year ended 31 December 2012 the Company was entitled to subsidies under the ADF amounting to €56,399,151

(2011: €63,369.428) as analysed below:

Financial Statements as at 31 December 2012 (Amounts in Euros unless otherwise stated) Page 35 of 54

5.2 Depreciation & amortisation charges 2012 2011

Analysis of depreciation & amortisation charges 4,076,131 4,009,580

0 21,530

Depreciation of owned assets

Depreciation of leased assets 83,612,292 83,549,250

Amortisation of intangible assets (15,076,887) (15,076,768)

Amortisation of cohesion fund related to intangible assets

72,611,536 72,503,592

Total depreciation & amortisation expenses

2012 2011

Refer to notes 5.7-5.9 for further information.

43,356,694 46,669,882

5.3 Net financial expenses 5,664,835 5,608,903

57,384 35,767

Analysis of net financial expenses

49,078,913 52,314,552

Financial expenses

(1,104,625) (5,220,362)

Interest expenses and related costs on bank loans

Unwinding of discount for long term liabilities (1,104,625) (5,220,362)

Other financial expenses 47,974,287 47,094,190

Financial expenses

Financial revenues

Bank interest income

Financial revenues

Net financial expenses

Interest and related expenses amounting to €43,572,327 (2011: €47,984,771) were paid during the year ended 31

December 2012.

The weighted average interest rate earned by the Company on its cash surplus (investments in time deposits and financial

assets) for 2012 was 0.50% (2011: 2.01%). The average maturity of the Company’s investments (time deposits and held-to-

maturity financial assets) for 2012 was 241 days (2011: 58 days).

5.4 Subsidies received

Airport Development Fund (ADF)

In accordance with law 2065/1992, as amended with law 2892/2001, the Greek State imposed a levy on all passengers

older than 5 years old, departing from Greek Airports, for the purpose of ensuring that passengers share the responsibility

for funding the commercial aviation infrastructure within the Hellenic Republic.

A passenger fee is collected by the airlines and consequently refunded to the Hellenic Civil Aviation Authority on a

monthly basis, through bank accounts opened with the Bank of Greece for each airport, in favour of the latter.

According to article 26.1 of law 2338/1995, the “Airport Development Agreement”, the Greek State undertook the

responsibility to collect the passenger fee over the period from 1/11/1994 to 1/11/2014. The Greek State also committed

that article 40 of law 2065/1992 “will not be amended or modified in any respect which materially prejudices the

financial return of the Airport Company”.

Based on the provisions of article 26.2 of law 2338/1995, in conjunction with article 16 of law 2892/2001, the airport company, at

all times prior to airport opening and at all times after the airport opening, is entitled to make withdrawals from the Spata Airport

Development Fund, in order to fund borrowing costs incurred in respect to loans received for funding infrastructure development.

For the year ended 31 December 2012 the Company was entitled to subsidies under the ADF amounting to €56,399,151

(2011: €63,369.428) as analysed below:

Financial Statements as at 31 December 2012 (Amounts in Euros unless otherwise stated) Page 35 of 54