Page 75 - 2board23full

P. 75

2011

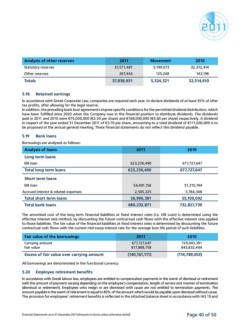

Analysis of other reserves 2011 Movement 2010

Statutory reserves 37,571,487 5,199,073 32,372,414

Other reserves 267,444 125,248 142,196

Totals 37,838,931 5,324,321 32,514,610

5.18 Retained earnings

In accordance with Greek Corporate Law, companies are required each year, to declare dividends of at least 35% of after

tax profits, after allowing for the legal reserve.

In addition, the prevailing bank loan agreements impose specific conditions for the permitted dividend distribution, which

have been fulfilled since 2003 when the Company was in the financial position to distribute dividends. The dividends

paid in 2011 and 2010 were €75,000,000 (€2.50 per share) and €168,000,000 (€5.60 per share) respectively. A dividend

in respect of the year ended 31 December 2011 of €3.70 per share, amounting to a total dividend of €111,000,000 is to

be proposed at the annual general meeting. These financial statements do not reflect this dividend payable.

5.19 Bank loans 2011 2010

Borrowings are analysed as follows:

623,236,490 677,727,647

Analysis of loans

Long term loans 623,236,490 677,727,647

EIB loan

Total long term loans

Short term loans 54,491,156 51,315,744

2,505,225 3,784,348

EIB loan

Accrued interest & related expenses 56,996,381 55,100,092

680,232,871 732,827,739

Total short term loans

Total bank loans

The amortised cost of the long term financial liabilities at fixed interest rates (i.e. EIB Loan) is determined using the

effective interest rate method, by discounting the future contractual cash flows with the effective interest rate applied

to those liabilities. The fair value of the financial liabilities at fixed interest rates is determined by discounting the future

contractual cash flows with the current mid-swap interest rate for the average loan life period of such liabilities.

Fair value of the borrowings 2011 2010

Carrying amount 677,727,647 729,043,391

Fair value 817,888,758 843,832,444

Excess of fair value over carrying amount (140,161,111) (114,789,053)

All borrowings are denominated in the functional currency.

5.20 Employee retirement benefits

In accordance with Greek labour law, employees are entitled to compensation payments in the event of dismissal or retirement

with the amount of payment varying depending on the employee’s compensation, length of service and manner of termination

(dismissal or retirement). Employees who resign or are dismissed with cause are not entitled to termination payments. The

amount payable in the event of retirement is equal to 40% of the amount which would be payable upon dismissal without cause.

The provision for employees’ retirement benefits is reflected in the attached balance sheet in accordance with IAS 19 and

Financial Statements as at 31 December 2011 (Amounts in Euros unless otherwise stated) Page 40 of 50

Analysis of other reserves 2011 Movement 2010

Statutory reserves 37,571,487 5,199,073 32,372,414

Other reserves 267,444 125,248 142,196

Totals 37,838,931 5,324,321 32,514,610

5.18 Retained earnings

In accordance with Greek Corporate Law, companies are required each year, to declare dividends of at least 35% of after

tax profits, after allowing for the legal reserve.

In addition, the prevailing bank loan agreements impose specific conditions for the permitted dividend distribution, which

have been fulfilled since 2003 when the Company was in the financial position to distribute dividends. The dividends

paid in 2011 and 2010 were €75,000,000 (€2.50 per share) and €168,000,000 (€5.60 per share) respectively. A dividend

in respect of the year ended 31 December 2011 of €3.70 per share, amounting to a total dividend of €111,000,000 is to

be proposed at the annual general meeting. These financial statements do not reflect this dividend payable.

5.19 Bank loans 2011 2010

Borrowings are analysed as follows:

623,236,490 677,727,647

Analysis of loans

Long term loans 623,236,490 677,727,647

EIB loan

Total long term loans

Short term loans 54,491,156 51,315,744

2,505,225 3,784,348

EIB loan

Accrued interest & related expenses 56,996,381 55,100,092

680,232,871 732,827,739

Total short term loans

Total bank loans

The amortised cost of the long term financial liabilities at fixed interest rates (i.e. EIB Loan) is determined using the

effective interest rate method, by discounting the future contractual cash flows with the effective interest rate applied

to those liabilities. The fair value of the financial liabilities at fixed interest rates is determined by discounting the future

contractual cash flows with the current mid-swap interest rate for the average loan life period of such liabilities.

Fair value of the borrowings 2011 2010

Carrying amount 677,727,647 729,043,391

Fair value 817,888,758 843,832,444

Excess of fair value over carrying amount (140,161,111) (114,789,053)

All borrowings are denominated in the functional currency.

5.20 Employee retirement benefits

In accordance with Greek labour law, employees are entitled to compensation payments in the event of dismissal or retirement

with the amount of payment varying depending on the employee’s compensation, length of service and manner of termination

(dismissal or retirement). Employees who resign or are dismissed with cause are not entitled to termination payments. The

amount payable in the event of retirement is equal to 40% of the amount which would be payable upon dismissal without cause.

The provision for employees’ retirement benefits is reflected in the attached balance sheet in accordance with IAS 19 and

Financial Statements as at 31 December 2011 (Amounts in Euros unless otherwise stated) Page 40 of 50