Page 62 - 2board23full

P. 62

Financial Statements

3 Financial risk management

3.1 Financial risk factors

The Company is exposed to financial risk, such as market risk (fluctuations in exchange rates and interest rates and price

risk), credit risk and liquidity risk. The general risk management program of the Company focuses on the unpredictability

of the financial markets, and attempts to minimize their potential negative influence on the financial performance of

the Company.

The financial risk management of the Company is performed internally by a qualified Unit, which operates under specific

rules that have been approved by the Board of Directors.

a) Exchange rate risk

Exchange rate risk occurs if future business transactions, recognized assets and liabilities and net investments in activities

outside the euro zone are expressed in a currency other than the functional currency of the Company (euro).

The Company’s exposure to foreign exchange risk is very limited since its business is substantially transacted in its

functional currency.

b) Cash flow and fair value interest rate risk

The cash flow interest rate risk is the risk of fluctuations in the future cash flows of a financial instrument as a result of

fluctuations in the market interest rate.

The Company has significant interest-bearing assets in the form of cash and cash equivalent (short term time deposits and

other highly liquid investments), thus profits and cash flows from investment activities are dependent in market interest

rates. During 2011 the Company’s cash and cash equivalent (short term time deposits and other liquid investments)

earned an effective interest rate amounting to 2,01% (2010: 2,92%). The impact from possible future interest rates on

the Company’s financial performance is presented below:

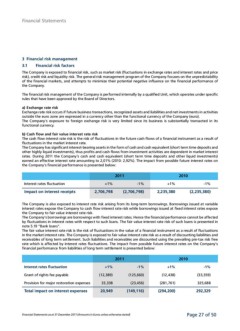

2011 2010

Interest rates fluctuation +1% -1% +1% -1%

Impact on interest receipts 2,706,798 (2,706,798) 2,235,380 (2,235,380)

The Company is also exposed to interest rate risk arising from its long-term borrowings. Borrowings issued at variable

interest rates expose the Company to cash flow interest rate risk while borrowings issued at fixed interest rates expose

the Company to fair value interest rate risk.

The Company’s borrowings are borrowings with fixed interest rates. Hence the financial performance cannot be affected

by fluctuations in interest rates with respect to such loans. The fair value interest rate risk of such loans is presented in

note 5.19 “Bank loans”.

The fair value interest rate risk is the risk of fluctuations in the value of a financial instrument as a result of fluctuations

in the market interest rate. The Company is exposed to fair value interest rate risk as a result of discounting liabilities and

receivables of long term settlement. Such liabilities and receivables are discounted using the prevailing pre-tax risk free

rate which is affected by interest rates fluctuations. The impact from possible future interest rates on the Company’s

financial performance from liabilities of long term settlement is presented below:

2011 2010

Interest rates fluctuation +1% -1% +1% -1%

Grant of rights fee payable (12,438) (33,359)

Provision for major restoration expenses (12,389) (125,660) (281,761) 325,688

Total impact on interest expenses 33,338 (23,456) (294,200) 292,329

20,949 (149,116)

Financial Statements as at 31 December 2011 (Amounts in Euros unless otherwise stated) Page 27 of 50

3 Financial risk management

3.1 Financial risk factors

The Company is exposed to financial risk, such as market risk (fluctuations in exchange rates and interest rates and price

risk), credit risk and liquidity risk. The general risk management program of the Company focuses on the unpredictability

of the financial markets, and attempts to minimize their potential negative influence on the financial performance of

the Company.

The financial risk management of the Company is performed internally by a qualified Unit, which operates under specific

rules that have been approved by the Board of Directors.

a) Exchange rate risk

Exchange rate risk occurs if future business transactions, recognized assets and liabilities and net investments in activities

outside the euro zone are expressed in a currency other than the functional currency of the Company (euro).

The Company’s exposure to foreign exchange risk is very limited since its business is substantially transacted in its

functional currency.

b) Cash flow and fair value interest rate risk

The cash flow interest rate risk is the risk of fluctuations in the future cash flows of a financial instrument as a result of

fluctuations in the market interest rate.

The Company has significant interest-bearing assets in the form of cash and cash equivalent (short term time deposits and

other highly liquid investments), thus profits and cash flows from investment activities are dependent in market interest

rates. During 2011 the Company’s cash and cash equivalent (short term time deposits and other liquid investments)

earned an effective interest rate amounting to 2,01% (2010: 2,92%). The impact from possible future interest rates on

the Company’s financial performance is presented below:

2011 2010

Interest rates fluctuation +1% -1% +1% -1%

Impact on interest receipts 2,706,798 (2,706,798) 2,235,380 (2,235,380)

The Company is also exposed to interest rate risk arising from its long-term borrowings. Borrowings issued at variable

interest rates expose the Company to cash flow interest rate risk while borrowings issued at fixed interest rates expose

the Company to fair value interest rate risk.

The Company’s borrowings are borrowings with fixed interest rates. Hence the financial performance cannot be affected

by fluctuations in interest rates with respect to such loans. The fair value interest rate risk of such loans is presented in

note 5.19 “Bank loans”.

The fair value interest rate risk is the risk of fluctuations in the value of a financial instrument as a result of fluctuations

in the market interest rate. The Company is exposed to fair value interest rate risk as a result of discounting liabilities and

receivables of long term settlement. Such liabilities and receivables are discounted using the prevailing pre-tax risk free

rate which is affected by interest rates fluctuations. The impact from possible future interest rates on the Company’s

financial performance from liabilities of long term settlement is presented below:

2011 2010

Interest rates fluctuation +1% -1% +1% -1%

Grant of rights fee payable (12,438) (33,359)

Provision for major restoration expenses (12,389) (125,660) (281,761) 325,688

Total impact on interest expenses 33,338 (23,456) (294,200) 292,329

20,949 (149,116)

Financial Statements as at 31 December 2011 (Amounts in Euros unless otherwise stated) Page 27 of 50