Page 76 - 2board23full

P. 76

08. Financial Statements

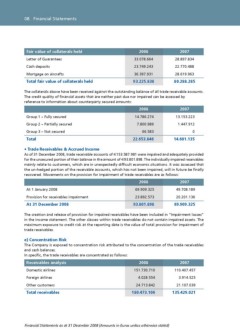

Fair value of collaterals held 2008 2007

Letter of Guarantees 33.078.664 28.897.834

Cash deposits 23.749.243 22.770.488

Mortgage on aircrafts 36.397.931 28.619.963

Total fair value of collaterals held 93.225.838 80.288.285

The collaterals above have been received against the outstanding balance of all trade receivable accounts.

The credit quality of financial assets that are neither past due nor impaired can be assessed by

reference to information about counterparty secured amounts:

2008 2007

Group 1 – Fully secured 14.786.274 13.153.223

Group 2 – Partially secured 7.800.989 1.447.912

Group 3 – Not secured 66.583 0

Total 22.653.846 14.601.135

• Trade Receivables & Accrued Income

As of 31 December 2008, trade receivable accounts of €153.587.981 were impaired and adequately provided

for the unsecured portion of their balance in the amount of €93.801.898. The individually impaired receivables

mainly relate to customers, which are in unexpectedly difficult economic situations. It was assessed that

the un-hedged portion of the receivable accounts, which has not been impaired, will in future be finally

recovered. Movements on the provision for impairment of trade receivables are as follows:

2008 2007

At 1 January 2008 69.909.325 49.708.189

Provision for receivables impairment 23.892.573 20.201.136

At 31 December 2008 93.801.898 69.909.325

The creation and release of provision for impaired receivables have been included in “Impairment losses”

in the income statement. The other classes within trade receivables do not contain impaired assets. The

maximum exposure to credit risk at the reporting date is the value of total provision for impairment of

trade receivables.

e) Concentration Risk

The Company is exposed to concentration risk attributed to the concentration of the trade receivables

and cash balances.

In specific, the trade receivables are concentrated as follows:

Receivables analysis 2008 2007

Domestic airlines 151.730.710 110.407.457

Foreign airlines 4.028.554 3.914.525

Other customers 24.713.842 21.107.039

Total receivables 180.473.106 135.429.021

Financial Statements as at 31 December 2008 (Amounts in Euros unless otherwise stated)

Fair value of collaterals held 2008 2007

Letter of Guarantees 33.078.664 28.897.834

Cash deposits 23.749.243 22.770.488

Mortgage on aircrafts 36.397.931 28.619.963

Total fair value of collaterals held 93.225.838 80.288.285

The collaterals above have been received against the outstanding balance of all trade receivable accounts.

The credit quality of financial assets that are neither past due nor impaired can be assessed by

reference to information about counterparty secured amounts:

2008 2007

Group 1 – Fully secured 14.786.274 13.153.223

Group 2 – Partially secured 7.800.989 1.447.912

Group 3 – Not secured 66.583 0

Total 22.653.846 14.601.135

• Trade Receivables & Accrued Income

As of 31 December 2008, trade receivable accounts of €153.587.981 were impaired and adequately provided

for the unsecured portion of their balance in the amount of €93.801.898. The individually impaired receivables

mainly relate to customers, which are in unexpectedly difficult economic situations. It was assessed that

the un-hedged portion of the receivable accounts, which has not been impaired, will in future be finally

recovered. Movements on the provision for impairment of trade receivables are as follows:

2008 2007

At 1 January 2008 69.909.325 49.708.189

Provision for receivables impairment 23.892.573 20.201.136

At 31 December 2008 93.801.898 69.909.325

The creation and release of provision for impaired receivables have been included in “Impairment losses”

in the income statement. The other classes within trade receivables do not contain impaired assets. The

maximum exposure to credit risk at the reporting date is the value of total provision for impairment of

trade receivables.

e) Concentration Risk

The Company is exposed to concentration risk attributed to the concentration of the trade receivables

and cash balances.

In specific, the trade receivables are concentrated as follows:

Receivables analysis 2008 2007

Domestic airlines 151.730.710 110.407.457

Foreign airlines 4.028.554 3.914.525

Other customers 24.713.842 21.107.039

Total receivables 180.473.106 135.429.021

Financial Statements as at 31 December 2008 (Amounts in Euros unless otherwise stated)