Page 110 - 2board23full

P. 110

Financial Statements

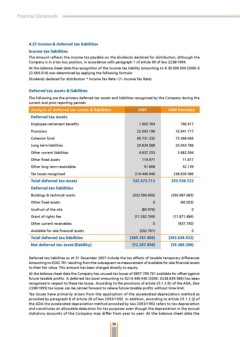

4.25 Income & deferred tax liabilities

Income tax liabilities

The amount reflects the income tax payable on the dividends declared for distribution, although the

Company is in a tax loss position, in accordance with paragraph 1 of article 99 of law 8/1994.

At the balance sheet date the recognition of the income tax liability amounting to € 0.000.000 (006 €

.669.014) was determined by applying the following formula:

Dividends declared for distribution * Income Tax Rate / (1- Income Tax Rate)

Deferred tax assets & liabilities

The following are the primary deferred tax assets and liabilities recognised by the Company during the

current and prior reporting periods:

Analysis of deferred tax assets & liabilities 2007 2006 Restated

Deferred tax assets

Employee retirement benefits 1.005.764 796.917

Provisions .04.196 16.941.717

Cohesion fund 69.71. 7.68.666

Long term liabilities 0.84.588 0.04.786

Other current liabilities 4.67.5 .48.094

Other fixed assets 119.971 11.817

Other long term receivables 51.668 5.19

Tax losses recognised 14.449.940 8.89.586

Total deferred tax assets 332.873.712 353.536.722

Deferred tax liabilities

Buildings & technical works (.594.900) (50.987.685)

Other fixed assets 0 (40.00)

Usufruct of the site (80.976) 0

Grant of rights fee (11.6.769) (11.871.484)

Other current receivables 0 (97.750)

Available for sale financial assets (0.761) 0

Total deferred tax liabilities (345.141.406) (363.836.922)

Net deferred tax asset/(liability) (12.267.694) (10.300.200)

Deferred tax liabilities as at 1 December 007 include the tax effects of taxable temporary differences

amounting to €0.761 resulting from the subsequent re-measurement of available for sale financial assets

to their fair value. This amount has been charged directly to equity.

At the balance sheet date the Company has unused tax losses of €857.799.761 available for offset against

future taxable profits. A deferred tax asset amounting to €14.449.940 (006: €8.89.586) has been

recognised in respect to these tax losses. According to the provisions of article 5.1..(k) of the ADA, (law

8/1995) tax losses can be carried forward to relieve future taxable profits without time limit.

Tax losses have primarily arisen from the application of the accelerated depreciation method as

provided by paragraph 8 of article 6 of law 09/199. In addition, according to article 5.1..(j) of

the ADA the accelerated depreciation method provided by law 09/199 refers to tax depreciation

and constitutes an allowable deduction for tax purposes even though the depreciation in the annual

statutory accounts of the Company may differ from year to year. At the balance sheet date the

58

4.25 Income & deferred tax liabilities

Income tax liabilities

The amount reflects the income tax payable on the dividends declared for distribution, although the

Company is in a tax loss position, in accordance with paragraph 1 of article 99 of law 8/1994.

At the balance sheet date the recognition of the income tax liability amounting to € 0.000.000 (006 €

.669.014) was determined by applying the following formula:

Dividends declared for distribution * Income Tax Rate / (1- Income Tax Rate)

Deferred tax assets & liabilities

The following are the primary deferred tax assets and liabilities recognised by the Company during the

current and prior reporting periods:

Analysis of deferred tax assets & liabilities 2007 2006 Restated

Deferred tax assets

Employee retirement benefits 1.005.764 796.917

Provisions .04.196 16.941.717

Cohesion fund 69.71. 7.68.666

Long term liabilities 0.84.588 0.04.786

Other current liabilities 4.67.5 .48.094

Other fixed assets 119.971 11.817

Other long term receivables 51.668 5.19

Tax losses recognised 14.449.940 8.89.586

Total deferred tax assets 332.873.712 353.536.722

Deferred tax liabilities

Buildings & technical works (.594.900) (50.987.685)

Other fixed assets 0 (40.00)

Usufruct of the site (80.976) 0

Grant of rights fee (11.6.769) (11.871.484)

Other current receivables 0 (97.750)

Available for sale financial assets (0.761) 0

Total deferred tax liabilities (345.141.406) (363.836.922)

Net deferred tax asset/(liability) (12.267.694) (10.300.200)

Deferred tax liabilities as at 1 December 007 include the tax effects of taxable temporary differences

amounting to €0.761 resulting from the subsequent re-measurement of available for sale financial assets

to their fair value. This amount has been charged directly to equity.

At the balance sheet date the Company has unused tax losses of €857.799.761 available for offset against

future taxable profits. A deferred tax asset amounting to €14.449.940 (006: €8.89.586) has been

recognised in respect to these tax losses. According to the provisions of article 5.1..(k) of the ADA, (law

8/1995) tax losses can be carried forward to relieve future taxable profits without time limit.

Tax losses have primarily arisen from the application of the accelerated depreciation method as

provided by paragraph 8 of article 6 of law 09/199. In addition, according to article 5.1..(j) of

the ADA the accelerated depreciation method provided by law 09/199 refers to tax depreciation

and constitutes an allowable deduction for tax purposes even though the depreciation in the annual

statutory accounts of the Company may differ from year to year. At the balance sheet date the

58