Page 94 - 2board23full

P. 94

FINANCIAL STATEMENTS

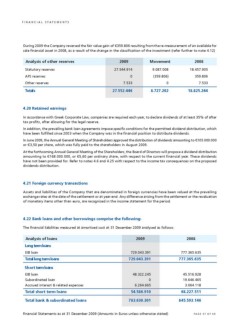

During 2009 the Company reversed the fair value gain of €359.806 resulting from the re-measurement of an available for

sale financial asset in 2008, as a result of the change in the classification of the investment (refer further to note 4.12)

Analysis of other reserves 2009 Movement 2008

Statutory reserves 27.544.914 9.087.008 18.457.905

AFS reserves 0 (359.806) 359.806

Other reserves 7.533

Totals 7.533 0

27.552.446 8.727.202 18.825.244

4.20 Retained earnings

In accordance with Greek Corporate Law, companies are required each year, to declare dividends of at least 35% of after

tax profits, after allowing for the legal reserve.

In addition, the prevailing bank loan agreements impose specific conditions for the permitted dividend distribution, which

have been fulfilled since 2003 when the Company was in the financial position to distribute dividends.

In June 2009, the Annual General Meeting of Shareholders approved the distribution of dividends amounting to €105.000.000

or €3,50 per share, which was fully paid to the shareholders in August 2009.

At the forthcoming Annual General Meeting of the Shareholders, the Board of Directors will propose a dividend distribution

amounting to €168.000.000, or €5,60 per ordinary share, with respect to the current financial year. These dividends

have not been provided for. Refer to notes 4.6 and 4.25 with respect to the income tax consequences on the proposed

dividends distribution.

4.21 Foreign currency transactions

Assets and liabilities of the Company that are denominated in foreign currencies have been valued at the prevailing

exchange rates at the date of the settlement or at year-end. Any difference arising from the settlement or the revaluation

of monetary items other than euro, are recognised in the income statement for the period.

4.22 Bank loans and other borrowings comprise the following:

The financial liabilities measured at amortised cost at 31 December 2009 analysed as follows:

Analysis of loans 2009 2008

Long term loans

EIB loan 729.043.391 777.365.635

Total long term loans 729.043.391 777.365.635

Short term loans 48.322.245 45.516.928

EIB loan 0 19.646.465

Subordinated loan

Accrued interest & related expenses 6.264.665 3.064.118

Total short term loans 54.586.910 68.227.511

783.630.301 845.593.146

Total bank & subordinated loans

Financial Statements as at 31 December 2009 (Amounts in Euros unless otherwise stated) PAGE 57 OF 69

During 2009 the Company reversed the fair value gain of €359.806 resulting from the re-measurement of an available for

sale financial asset in 2008, as a result of the change in the classification of the investment (refer further to note 4.12)

Analysis of other reserves 2009 Movement 2008

Statutory reserves 27.544.914 9.087.008 18.457.905

AFS reserves 0 (359.806) 359.806

Other reserves 7.533

Totals 7.533 0

27.552.446 8.727.202 18.825.244

4.20 Retained earnings

In accordance with Greek Corporate Law, companies are required each year, to declare dividends of at least 35% of after

tax profits, after allowing for the legal reserve.

In addition, the prevailing bank loan agreements impose specific conditions for the permitted dividend distribution, which

have been fulfilled since 2003 when the Company was in the financial position to distribute dividends.

In June 2009, the Annual General Meeting of Shareholders approved the distribution of dividends amounting to €105.000.000

or €3,50 per share, which was fully paid to the shareholders in August 2009.

At the forthcoming Annual General Meeting of the Shareholders, the Board of Directors will propose a dividend distribution

amounting to €168.000.000, or €5,60 per ordinary share, with respect to the current financial year. These dividends

have not been provided for. Refer to notes 4.6 and 4.25 with respect to the income tax consequences on the proposed

dividends distribution.

4.21 Foreign currency transactions

Assets and liabilities of the Company that are denominated in foreign currencies have been valued at the prevailing

exchange rates at the date of the settlement or at year-end. Any difference arising from the settlement or the revaluation

of monetary items other than euro, are recognised in the income statement for the period.

4.22 Bank loans and other borrowings comprise the following:

The financial liabilities measured at amortised cost at 31 December 2009 analysed as follows:

Analysis of loans 2009 2008

Long term loans

EIB loan 729.043.391 777.365.635

Total long term loans 729.043.391 777.365.635

Short term loans 48.322.245 45.516.928

EIB loan 0 19.646.465

Subordinated loan

Accrued interest & related expenses 6.264.665 3.064.118

Total short term loans 54.586.910 68.227.511

783.630.301 845.593.146

Total bank & subordinated loans

Financial Statements as at 31 December 2009 (Amounts in Euros unless otherwise stated) PAGE 57 OF 69