Page 100 - 2board23full

P. 100

FINANCIAL STATEMENTS

Company recognised a deferred tax liability on the outstanding accelerated depreciation, net of the corresponding

accelerated amortisation of the cohesion fund, amounting to €231.022.476 (2008: €243.636.545).

The Company’s tax losses for the years 2004 to 2009 are still subject to audit and final assessment by the tax

authorities.

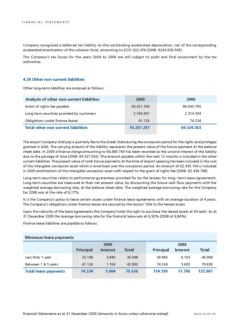

4.26 Other non-current liabilities 2009 2008

90.421.540 86.935.795

Other long-term liabilities are analysed as follows:

2.744.601 2.314.354

Analysis of other non-current liabilities 41.126 74.234

Grant of rights fee payable

Long term securities provided by customers 93.207.267 89.324.383

Obligations under finance leases

Total other non-current liabilities

The airport Company shall pay a quarterly fee to the Greek State during the concession period for the rights and privileges

granted in ADA. The carrying amount of the liability represents the present value of the future payment at the balance

sheet date. In 2009 a finance charge amounting to €4.485.745 has been recorded as the unwind interest of the liability

due to the passage of time (2008: €4.327.002). The amount payable within the next 12 months is included in the other

current liabilities. The present value of total future payments at the time of airport opening has been included in the cost

of the intangible concession asset which is amortised over the concession period. An amount of €2.435.104 is included

in 2009 amortisation of the intangible concession asset with respect to the grant of rights fee (2008: €2.436.748).

Long-term securities relate to performance guarantees provided for by the lessees for long- term lease agreements.

Long-term securities are measured at their net present value, by discounting the future cash flow payments with the

weighted average borrowing rate, at the balance sheet date. The weighted average borrowing rate for the Company

for 2008 was at the rate of 6,17%.

It is the Company’s policy to lease certain assets under finance lease agreements with an average duration of 4 years.

The Company’s obligations under finance leases are secured by the lessors’ title to the leased assets.

Upon the maturity of the lease agreements the Company holds the right to purchase the leased assets at €3 each. As at

31 December 2009 the average borrowing rate for the financial lease was at 6,50% (2008 at 6,84%).

Finance lease liabilities are payable as follows:

Minimum lease payments

2009 2008

Principal

Interest Total Principal Interest Total

46.068

Less than 1 year 33.108 3.840 36.948 39.965 6.103 79.839

125.907

Between 1 & 5 years 41.126 1.764 42.890 74.234 5.605

Total lease payments 74.234 5.604 79.838 114.199 11.708

Financial Statements as at 31 December 2009 (Amounts in Euros unless otherwise stated) PAGE 63 OF 69

Company recognised a deferred tax liability on the outstanding accelerated depreciation, net of the corresponding

accelerated amortisation of the cohesion fund, amounting to €231.022.476 (2008: €243.636.545).

The Company’s tax losses for the years 2004 to 2009 are still subject to audit and final assessment by the tax

authorities.

4.26 Other non-current liabilities 2009 2008

90.421.540 86.935.795

Other long-term liabilities are analysed as follows:

2.744.601 2.314.354

Analysis of other non-current liabilities 41.126 74.234

Grant of rights fee payable

Long term securities provided by customers 93.207.267 89.324.383

Obligations under finance leases

Total other non-current liabilities

The airport Company shall pay a quarterly fee to the Greek State during the concession period for the rights and privileges

granted in ADA. The carrying amount of the liability represents the present value of the future payment at the balance

sheet date. In 2009 a finance charge amounting to €4.485.745 has been recorded as the unwind interest of the liability

due to the passage of time (2008: €4.327.002). The amount payable within the next 12 months is included in the other

current liabilities. The present value of total future payments at the time of airport opening has been included in the cost

of the intangible concession asset which is amortised over the concession period. An amount of €2.435.104 is included

in 2009 amortisation of the intangible concession asset with respect to the grant of rights fee (2008: €2.436.748).

Long-term securities relate to performance guarantees provided for by the lessees for long- term lease agreements.

Long-term securities are measured at their net present value, by discounting the future cash flow payments with the

weighted average borrowing rate, at the balance sheet date. The weighted average borrowing rate for the Company

for 2008 was at the rate of 6,17%.

It is the Company’s policy to lease certain assets under finance lease agreements with an average duration of 4 years.

The Company’s obligations under finance leases are secured by the lessors’ title to the leased assets.

Upon the maturity of the lease agreements the Company holds the right to purchase the leased assets at €3 each. As at

31 December 2009 the average borrowing rate for the financial lease was at 6,50% (2008 at 6,84%).

Finance lease liabilities are payable as follows:

Minimum lease payments

2009 2008

Principal

Interest Total Principal Interest Total

46.068

Less than 1 year 33.108 3.840 36.948 39.965 6.103 79.839

125.907

Between 1 & 5 years 41.126 1.764 42.890 74.234 5.605

Total lease payments 74.234 5.604 79.838 114.199 11.708

Financial Statements as at 31 December 2009 (Amounts in Euros unless otherwise stated) PAGE 63 OF 69