Page 96 - 2board23full

P. 96

Financial Statements

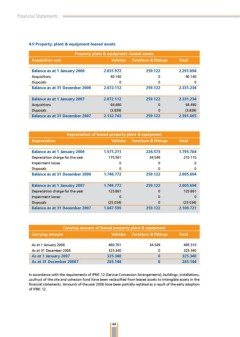

4.9 Property, plant & equipment-leased assets

Acquisition cost Property plant & equipment -leased assets Total

Vehicles Furniture & fittings

2.291.094

Balance as at 1 January 2006 2.031.972 259.122 40.140

Acquisitions 40.140 0 0

Disposals 0 0

2.331.234

Balance as at 31 December 2006 2.072.112 259.122

2.331.234

Balance as at 1 January 2007 2.072.112 259.122 64.490

Acquisitions 64.490 0 (.859)

Disposals (.859) 0

2.391.865

Balance as at 31 December 2007 2.132.743 259.122

Depreciation Depreciation of leased property plant & equipment Total

Vehicles Furniture & fittings

1.795.784

Balance as at 1 January 2006 1.571.211 224.573 10.110

Depreciation charge for the year 175.561 4.549 0

Impairment losses 0 0 0

Disposals 0 0

2.005.894

Balance as at 31 December 2006 1.746.772 259.122

2.005.894

Balance as at 1 January 2007 1.746.772 259.122 15.861

Depreciation charge for the year 15.861 0 0

Impairment losses 0 0 (5.04)

Disposals (5.04) 0

2.106.721

Balance as at 31 December 2007 1.847.599 259.122

Carrying amount of leased property plant & equipment

Carrying amount Vehicles Furniture & fittings Total

As at 1 January 006 460.761 4.549 495.10

As at 1 December 006 5.40 0 5.40

As at 1 January 2007 325.340 0 325.340

As at 31 December 20007 285.144 0

285.144

In accordance with the requirements of IFRIC 1 (Service Concession Arrangements), buildings, installations,

usufruct of the site and cohesion fund have been reclassified from leased assets to intangible assets in the

financial statements. Amounts of the year 006 have been partially restated as a result of the early adoption

of IFRIC 1.

44

4.9 Property, plant & equipment-leased assets

Acquisition cost Property plant & equipment -leased assets Total

Vehicles Furniture & fittings

2.291.094

Balance as at 1 January 2006 2.031.972 259.122 40.140

Acquisitions 40.140 0 0

Disposals 0 0

2.331.234

Balance as at 31 December 2006 2.072.112 259.122

2.331.234

Balance as at 1 January 2007 2.072.112 259.122 64.490

Acquisitions 64.490 0 (.859)

Disposals (.859) 0

2.391.865

Balance as at 31 December 2007 2.132.743 259.122

Depreciation Depreciation of leased property plant & equipment Total

Vehicles Furniture & fittings

1.795.784

Balance as at 1 January 2006 1.571.211 224.573 10.110

Depreciation charge for the year 175.561 4.549 0

Impairment losses 0 0 0

Disposals 0 0

2.005.894

Balance as at 31 December 2006 1.746.772 259.122

2.005.894

Balance as at 1 January 2007 1.746.772 259.122 15.861

Depreciation charge for the year 15.861 0 0

Impairment losses 0 0 (5.04)

Disposals (5.04) 0

2.106.721

Balance as at 31 December 2007 1.847.599 259.122

Carrying amount of leased property plant & equipment

Carrying amount Vehicles Furniture & fittings Total

As at 1 January 006 460.761 4.549 495.10

As at 1 December 006 5.40 0 5.40

As at 1 January 2007 325.340 0 325.340

As at 31 December 20007 285.144 0

285.144

In accordance with the requirements of IFRIC 1 (Service Concession Arrangements), buildings, installations,

usufruct of the site and cohesion fund have been reclassified from leased assets to intangible assets in the

financial statements. Amounts of the year 006 have been partially restated as a result of the early adoption

of IFRIC 1.

44